I am focused on flows that fulfill demand. When persuasive (my preferred term is effectual) pull signals are received, I want push to deliver what is wanted, when and where it is wanted.

For too long these targets have not been consistently achieved. Flows have been enormous. Delivery has usually happened. But too often demand has not been fulfilled in a timely way. In some cases, demand remains unfulfilled.

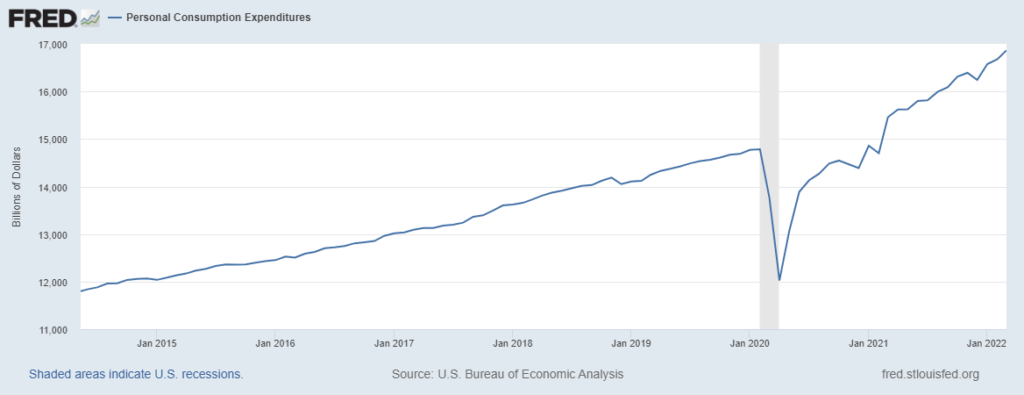

Each failure has its own story, but this plot’s principal antagonist is well-above typical demand. Below is our recent run-of-show ala Personal Consumption Expenditures. The new April numbers will be out on Friday, but I will be flying then and may be off-line for a few days.

As previously outlined (here and here), I perceived some easing of supply chain stress in December through late February. But data and chatter have been less clear since Russia invaded Ukraine and Beijing shut-down Shanghai. Now some data-informed observations seem to confirm increasing supply chain stress (here and here).

Does this additional stress reflect increased supply-side problems? There are plenty such problems, even more since late February. But for US-focused flows most of the evidence still implicates demand as most influential.

On Monday, CNBC interviewed Brian Moynihan. The Bank of America CEO tells us this about his customers:

[Their] balances continue to be stable and continue to grow year over year for the broad base of consumers. More importantly, the spending levels in May for the first few weeks are up 10 percent last May, and that is not as high as it would otherwise be because last May people paid taxes, so it actually — it’s a bigger base to grow from. So year to date, they’re up 17 percent fairly standard. In May they’re up 17 percent. The consumers continue to spend. In the balances of our customers, they have more money in April. Their balances were up in March and they grew over all way back to mid last year. So the notion that people are spending the stimulus down isn’t happening yet. It may happen but it hasn’t happened yet.

Significantly higher food prices have not (yet) reduced overall demand for groceries or eating out. The even sharper increase in gasoline prices has (so far) not noticeably impacted demand (though what I see as flat, others perceive as seasonally softer than usual) (plus more and more). Walmart, Target, and other retailers recently reported considerably increased consumption. During the first quarter consumers spent about three percent more at Walmart and the company expects 3.5 percent more in the current quarter. Demand for air travel has increased in May and Deloitte predicts a strong summer travel season.

Since at least October (here), I have expected some sustained softening of pull. This has not happened. American consumers have mostly continued to increase spending (one exception here). Push capacity is often more symmetrical than one year ago because pull is less concentrated. But otherwise demand continues to exceed production and/or transportation capacity for several products and even product categories (e.g. new cars).

Given other indicators, I will be surprised if Friday’s PCE totals do not continue recent upward angles. But it is important to see what is being consumed: the proportional mix of expenditures. Moreover, how much of any nominal increase is obviated by inflation? Are US consumers really pulling more or mostly pulling close-to-the-same at higher prices? For demand and supply to be better balanced, pull needs to be more diversified than over the last two years. Pull also needs to be more consistent with push capacity that accurately reflects fundamental demand, rather than a fun-house mirror of volatility.