Since November this blog has looked at five vital signs (recently amended).

North American Agricultural Production: USDA is reporting a strong start to the US planting season. By May 7 farmers had planted half of the nation’s corn crop, more than a quarter ahead of May 2021-22. Around 35 percent of the nation’s soybean acreage was planted by May 7, also roughly a quarter ahead of last year. Flooding in California (and elsewhere) has delayed and complicated some fresh vegetable production. The prospect of improved irrigation levels is, however, much better news than the drought of recent years.. More and more and more and more. (In its April update the European Commission forecast that EU cereal production in May 2023-24 would be 287.1 million metric tons, against 267.9 million mt last year. Flows of grain from Ukraine remain constrained, both through the Black Sea and west into the EU.)

Global Natural Gas Demand and Supply: Fossil fuel energy markets have been soft and softer coming out of the Northern Hemisphere’s heating season and a slow (incremental? gradual? discouraging?) recovery in China combined with prospects for a US economic slowdown. US inventories of natural gas are about one-fifth above five year averages and almost one-third higher than last May. US Prices (Henry Hub) are back at late 2019/early 2020 lows. Both European prices (Dutch TTF) and Asian prices (Japan-Korea Marker) have reclaimed pre-war market levels. More and more and more and more.

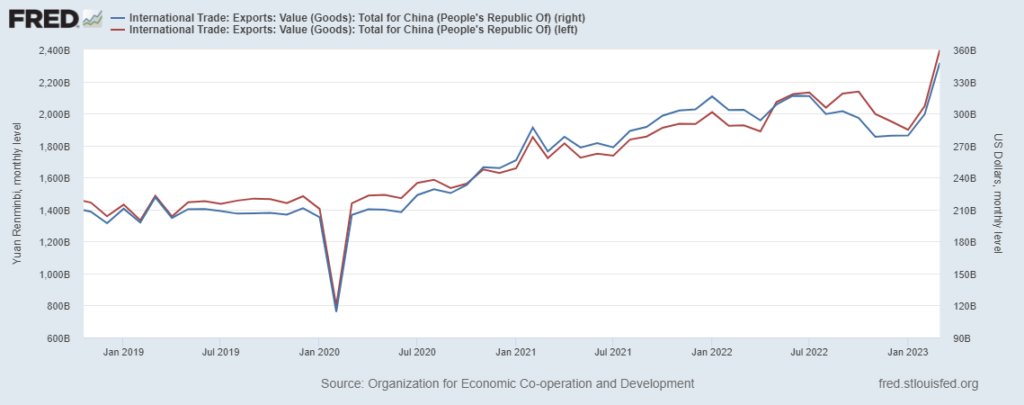

China Export Volumes and Value: On May 9 Reuters reported, “China’s imports contracted sharply in April, while exports rose at a slower pace, reinforcing signs of feeble domestic demand despite the lifting of COVID curbs and heaping pressure on an economy already struggling in the face of cooling global growth.” Global pull is muted, so China’s push is a bit less vigorous (the manufacturing PMI has actually contracted). China’s domestic demand has not roared back as some had hoped (more and more and more). China’s exports to the US are down by over six percent. China’s imports from the US are down more than three percent (including reduced imports of corn as China shifts to less expensive Brazilian suppliers). But… April’s outcomes should be viewed in the context of HUGE outbound flows from China far exceeding pre-pandemic patterns. Please see second chart below, showing exports through the end of March.

North American Grid Capacity: On May 11 there was a meeting of the Board of Trustees of the North America Electric Reliability Corporation (NERC). Several capacity challenges were discussed. According to meeting minutes early in the session NERC President and CEO James B. Robb noted, “the continuing challenges of preparing the grid to operate reliably during extreme weather events. He also stressed the need to shift how industry plans for energy sufficiency and essential reliability services, recognizing that one no longer brings the other in light of the changing resource mix” (my italics added). Next week (May 17) NERC will release its summer reliability assessment. According to Reuters, a board meeting preview indicated, “if summer temperatures spike and become more widespread, the U.S. West, Midwest, Texas and Southeast, New England and Ontario (in Canada) may experience resource shortfalls.” Not surprising. But as we have seen, surprises are still possible.

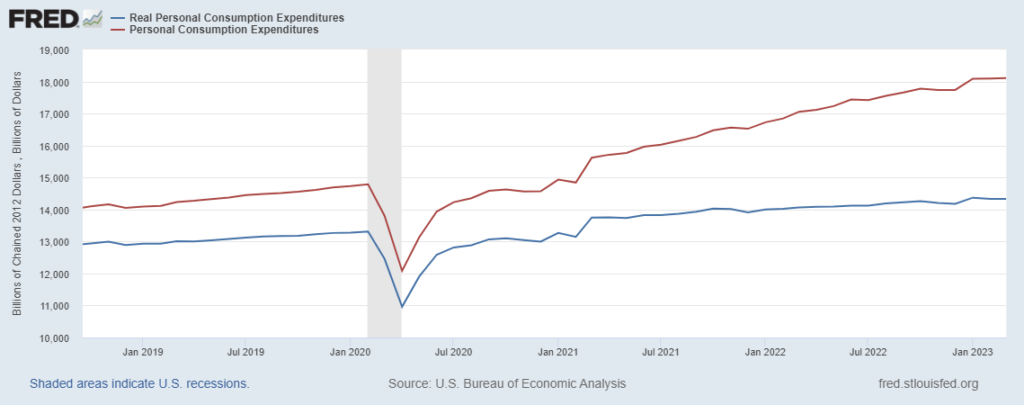

US Personal Consumption Expenditures: This blog gave specific attention to the most recent PCE results (here and here). Nominal PCE is flat, real PCE is slightly lower (see chart below). Last week’s Consumer Price Index for April suggests recent trends are persisting (here and here). Adjusted for inflation, US consumption expenditures are now broadly consistent with pre-pandemic trend patterns. Current wage patterns should support something close to this trend continuing. Constrained credit-markets and related purposeful demand destruction should restrain upward movement. Pull and push are close to equilibrium… for now.

Late last month I had some troublesome chest-pain. I had no preexisting conditions. At my primary care physician’s office they checked my vital signs: all superb. My anxiety (and theirs) immediately subsided. It took awhile but an odd, entirely ephemeral cause was finally diagnosed. A couple of modest interventions and two weeks later the pain is mostly gone. What I see above is also a strong set of vital signs. Unfortunately, sources of anxiety for global supply chains do not strike me as quite so transient.