For the last year plus I have emphasized the role of extraordinary demand in disrupting supply. For example, here and here and here. This angle emerges from a perception that contemporary supply capacity is organized around — essentially emerges from — demand. A sudden shift in demand misaligned with capacity will inevitably disrupt flows. So, I look at the slope of US Personal Consumption Expenditures (including sub-components) since Spring 2021 and see a recurring cause of stock-outs, freight congestion, production gyrations, more hires, price increases, and related.

It is worth emphasizing, this blog focuses on Supply Chain Resilience. I am mostly concerned with how demand influences physical flows.

I confess to often treating even stubbornly constrained supplies as (usually, eventually, really) demand dependent. For example, I trace reduced supply of new vehicles to reduced supply of legacy semiconductors that, I argue, emerged from sharp declines in demand for new vehicles in spring 2020. Vehicle manufacturers slashed orders of semiconductors. Production capacity for semiconductors was shifted to other higher margin categories (suddenly in much higher demand). When demand for new vehicles surged several weeks later there was no longer sufficient production capacity to make and deliver the semiconductors needed.

Is this outcome supply-driven or demand-driven? Both for sure. But for what it’s worth, for me these specific swings in demand seem causal, while the resulting shortages are symptomatic. (To acknowledge supply driven possibilities: reduced wheat supplies resulting from Russia’s invasion of Ukraine are not demand-driven.)

Symptoms cannot be ignored. But I mostly want to understand and focus on causes.

Adam Hale Shapiro at the Federal Reserve Bank of San Francisco is as concerned with causes of inflation as I am concerned with how shifts in demand can cause supply complications. These are distinct, but related angles on our shared reality.

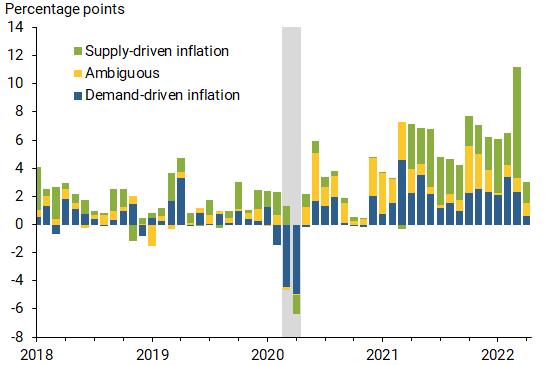

Yesterday Dr. Shapiro authored an Economic Letter which, “highlights that both supply and demand factors are responsible for current elevated inflation levels. Supply factors explain about half of the difference between current 12-month PCE inflation and pre-pandemic inflation levels, and the effects appear to be rising more recently. Demand factors are responsible for about a third of the difference, and those effects appear to be diminishing more recently. The remainder is due to factors that cannot be definitively labeled as supply or demand. The large impact of supply factors implies that inflationary pressures will not completely subside until labor shortages, production constraints, and shipping delays are resolved.”

Below is a visual break-down of how this analysis compares and contrasts the interplay of demand and supply factors on inflation.

Dr. Shapiro’s method is as fine-grained as my approach is superficial. I am not quite sure — yet — if his careful method offers insight on how demand influences physical supply. I need to read and think some more — when not as distracted as right now. If readers see promising connections, please let me know. It is, in any case, a constructive and provocative presentation worth your reading — before I swing in with my supply chain resilience bias

+++

June 25 Update: Too many meetings and urgent requests for “professional (disguised personal) judgments” on emergent reality have left little time for actual thinking by me. But for your consideration, I will pass along recent thinking on related issues from two thoughtful observers.

On Thursday at the Financial Times, Robert Armstrong (or his headline writer) concludes: Supply Won’t Save Us. He agrees with Dr. Shapiro that, “The data on supply tells a mixed story.” Armstrong then reviews various data and indices that to him (and me) detail significantly improved equilibrium of demand and supply compared to late last year. But his concerns go beyond supply chain resilience. The rate of change from bad to better for supply chains (my problem) is not accelerating fast enough for his problem: “Nice, growth-friendly disinflation from the supply side, it seems, isn’t coming to save us.” In other words, the current rate of supply chain improvement will not save us from an inflation-fighting recession (with follow-on implications for supply chains too).

Helpfully, yesterday this rate-of-change issue was the principal topic in Paul Krugman’s newsletter. Here is a chunk of how he starts:

| A hot economy leads to higher wages and prices. When demand for labor is strong, workers can and do demand wage hikes; when demand for goods and services is strong, businesses have “pricing power,” or the ability to raise prices without losing customers. But does a hot economy lead to a higher level of prices? Or does it lead to a higher rate of change in prices, i.e., ongoing inflation? Or maybe even to accelerating inflation, a higher rate of change in the rate of change? These may sound like abstruse questions, but they aren’t. |

Krugman is also not focused on supply chain resilience per se. But it seems to me — admittedly, a bit vaguely right now — that the rate of change in production capacity, demand velocity, and related flows will also be crucial to how the feedback loops between supply, demand, wages, employment, price increases, inflationary pressures, and potential recession play together over the next several months. Will they be “nice, growth friendly” or not?

Obviously I am thinking out loud with you — even more uncertainly than usual. Perhaps I am just babbling at you. I am on a long plane ride today (if a fueled plane with flight crew shows up). Maybe that will finally provide time for real thinking. As the whole rate-of-change angle suggests, duration can be a crucial factor.

Shapiro’s assessment of causal contributions to inflation: Supply versus Demand