On January 7 President Biden argued for a crucial policy distinction:

If car prices are too high right now, there are two solutions: You increase the supply of cars by making more of them, or you reduce demand for cars by making Americans poorer. That’s the choice.

Given our current context, the President might have said: you increase the supply of cars by making more legacy semiconductors or…

But point made and point taken. There is a place for boldfaced claims.

There is also a place for more nuanced understanding. Recent price increases — especially boldfaced price increases — reflect a messy collision of increased demand, shifting demand, and a wide range of supply issues, including long-standing capacity constraints as well as more recent production disruptions, freight congestion, and workforce limitations (often tied to covid).

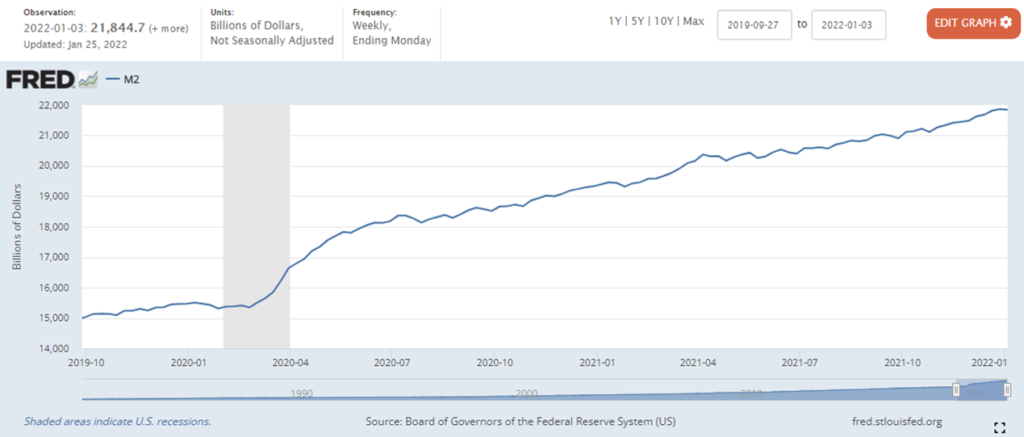

There is much more money available to US consumers than typical. In the first week of January 2020, the M2 money supply in the United States was $15,504 billion. In the first week of January 2022 there was $21,845 billion available. (See chart below.) That is close to 30 percent extra liquidity.

During the pandemic, flux in supply has been very uneven, but in terms of overall proportions, supplies of goods and services have not increased anywhere close to 30 percent. Real GDP per capita increased less than 3 percent from Q4 2019 to Q4 2021. The Federal Reserve tries to measure changes in manufacturing output per job. Where 2012 output per job equals 100, the Q4 2019 level was 94.5. The Q4 2021 level was 98.

The supply of money has grown much faster than the supply of stuff (and even faster compared to reductions in many services).

This increased supply of money reflects (in part) a significant reduction in velocity of the money supply. During 2020 many Americans saved much more than usual. Not spending on travel, eating-out, entertainment, and more has slowed and pooled money flows. In early 2021 some of this savings began to be spent — and expenditure of current income returned to pre-pandemic patterns. But for millions of consumers, billions of unspent dollars have, so-far, mostly stayed in their pockets.

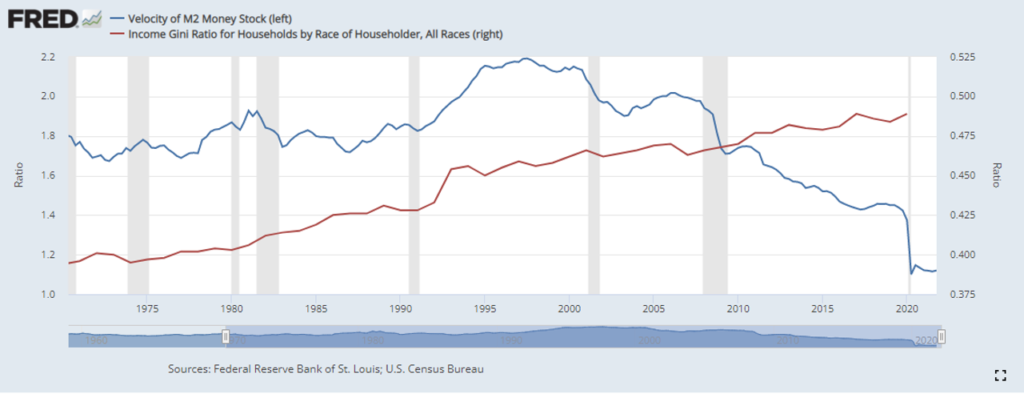

As demonstrated in the chart below, the speed with which money is used to buy stuff (blue line) has declined precipitously over the last quarter-century. During the pandemic many Americans further slowed their transaction pace. The turnover rate of money is now about half what it was in the mid-1990s.

As the red line on the chart above suggests, velocity of the money supply has declined as US income inequality has increased. The pandemic (once again) has amplified a preexisting trend. The Gini Index (here and here) works to measure the population-wide dispersion of income as more or less proportionally equal. I read the chart immediately above to say that since the great recession (2008), the proportion of people who can afford not to spend their available cash has increased substantially. Roughly one-third of US households live paycheck-to-paycheck (supporting higher velocity of money). But for another quarter to one-third of households, a significant proportion of cash-on-hand is not immediately needed (here and here and here).

Retail sales have recovered and in some categories much more than recovered. But given cash available, demand has arguably been restrained. Even Amazon is reporting much slower revenue growth. Given velocity of the money supply, it is even possible to say that spending has been sluggish.

In some cases, new cars for example, the sales slowdown is clearly the result of supply constraints. Manufacturers have not been able to build as many cars as consumers want because of a collapse in the supply chain for particular types of semiconductors. Before the pandemic more than 17 million new cars were sold most months. Since March 2020 this sales threshold has been achieved only three times. In September 2021 fewer than 13 million new cars were sold. In December 2021 barely 13.5 million.

Some smart market participants are joining President Biden in pointing to supply now being the core problem. A January report from BlackRock argues:

The start of the pandemic was dominated by an economy-wide supply shock: activity was deliberately brought to a halt to curb the spread of the virus. As restrictions were lifted and the powerful restart took hold, it proved difficult to bring production back online as quickly. Through 2021 the restart saw the emergence of more sector-specific supply problems, driven by the sudden and sharp shift in consumer spending away from services and towards goods. This shift in the mix of demand created bottlenecks in goods-producing sectors as supply struggled to keep pace. Meanwhile, it created spare capacity in service industries. This has driven inflationary pressure in goods sectors, which have seen the largest price rises… Pricing pressures have been most acute in sectors that have been particularly affected by bottlenecks, such as autos. This explains why there is so much inflation overall even though economies have yet to reach full employment.

I agree with the foregoing. But the team at BlackRock then tries to argue away the role of demand, extraordinary growth in the money supply, and the proportional slowdown in transactions. They conclude, “inflation is being and will continue to be driven more by limits on supply capacity than excessive demand pressure.”

Disequilibrium of demand and supply always reflects an interaction of pull and push. The classic Beer Game exposes perpetual impacts of (mis)perception on both push and pull. Network science demonstrates the stigmergic disposition of social behavior where feedback pulls action that pushes more feedback that prompts more action. Evidence accumulates that for equilibrium to (re)emerge systems self-organize around an attractor. BlackRock has evidently decided supply is the key attractor to resolve our current disequilibrium.

BlackRock is not alone in this inclination. Larry Summers recently wrote that over the last year many policy-makers have, “failed to appreciate just how quickly the economy could shift from being demand-constrained to supply-constrained.” In recent days both Bloomberg and the New York Times have focused on supply constraints as the premier economic challenge. Last week the International Monetary Fund’s World Economic Outlook for 2022 highlighted many supply constraints and said very little about demand dynamics.

I certainly recognize real and stubborn constraints in supply capacity. No serious person is suggesting a strict either/or. Reducing supply frictions and shaping demand behavior both need to be on the policy tool belt. But simultaneously attending to each often requires trade-offs. Which factor, push or pull, is given policy priority will have consequences.

I remain skeptical that even if most supply problems were solved this would move us closer to equilibrium. In my experience (and understanding of theory) supply organizes around demand. If supply functions and flows were magically elastic — given current liquidity levels, inflation would probably be even stronger. Until demand stops pulling quite as hard, streams of supply will continue to be crowded and choppy. Push capacity added to fulfill recent demand will be shed once demand diminishes.

In December 2019 US retail sales were $529.6 billion (November: $527.8) Supply and demand were perceived to be in rough equilibrium. For December 2021 US retail sales were $626.8 billion (November: $639.1 billion). Even after subtracting for inflation, demand was pulling at least one-fifth more. This caused serious disequilibrium. What’s really amazing is how well supply chains have fulfilled this huge surge.

Late in 2020’s first quarter and continuing into the second quarter there was evidence for a demand constrained economy. But since the second half of the first pandemic year and especially since March 2021 the United States has been navigating a demand inflamed economy. Demand dramatically dropped in some categories and migrated, often promiscuously, to other categories. These volatile shifts in pull have challenged production and distribution capacities spawning congestion, especially at places where many flows intersect such as seaports and distribution centers. As if these covid-related demand gyrations were not bad enough, the pandemic has also pinched push capacity, especially by rather randomly reducing workforce participation and productivity.

Automobile manufacturing has been supply constrained. Mitigating the semiconductor shortage will increase supplies and, eventually, moderate price-increases. More spending on cars will redirect consumption from other product categories. This will mitigate some demand inflammation. In January 2022 three million more vehicles were sold than in December. At least two million more per month need to be sold before the new car market is better balanced with potential demand, but the current direction is encouraging.

The personal saving rate, at 7.9 percent, is now much more inline with historical patterns. In December 2021 disposable income remained about four percent higher than December 2019. This is, however, a soft glow compared to the raging fire of 23 percent higher in March 2021 compared to March 2019. That level of inflamed demand self-immolates supply capacity.

Especially as spending on services, entertainment, travel and such has recovered, accumulated savings is being gradually spent down (e.g., December 2021 spending at food and drinking establishments was almost one-third higher than in 2020. For all of 2021 eating and drinking out was about six percent higher than for all of 2019). Savings accumulated by high-earners is beginning to circulate in the economy again.

At the end of December the M2 money supply (first chart above) was almost one-third above 2019’s close. This is, in my opinion, too much gain too fast. This sharp increase in implied demand exceeds the adaptive capacity of most mature supply chains. (Skepticism regarding this level of demand persisting also discourages adaptation.) M2’s rate of growth has started to slow. Increased velocity of the money supply could appear soon, if people and their money can continue to circulate more and more.

Fiscal and monetary policy makers are being encouraged to navigate an economic “soft landing” where interest rates and other tools are deployed to brake inflation without prompting high unemployment (here and here and here). There is growing concern that supply chain bottlenecks and related problems will buffet the runway, threatening a crash landing. China’s zero-covid strategy has (and will) cause stop-and-go upstream congestion. But more even flows can be consciously cultivated.

To facilitate less friction in flows, the swollen M2 money supply needs to be consistently and gradually pumped into the economy, preferably into sectors, such as automobiles and travel, that have seen less than their typical share. This will reduce “excess demand” for other categories, mitigating stress on midstream and upstream sources serving those categories. Diversification (de-concentration) of demand will reduce physical congestion across supply chains. As congestion is reduced, supply chain assets (e.g., dock velocity, truckers and trucks) can be more effectively deployed. Inventories can be rebuilt. As M2’s current excess supply is reduced, pull-capacity will be better balanced with push-capacity and a rough equilibrium of demand and supply can be reestablished.

Rather than a soft-landing analogy, I prefer an aerial refueling analogy. The United States wants/needs its economy to continue at close to current speed and altitude. We want to avoid a forced-landing. We would prefer that recent inflammation not become long-term inflation. Stable prices with maximum sustainable employment is where we want to go. Our huge reserves of M2 are important sources for fueling this flight. Price increases add friction. Cash in our pockets lubricates.

Safe and effective aerial refueling requires careful calibration of source with receiver and a continuous link. Covid is a potential complication, but our recent experience with omicron may suggest that demand and supply networks have figured out how to calibrate even with considerable cross-winds.

Pent-up (at times premature) demand for post-pandemic lifestyles should continue to calibrate (and accelerate) M2s velocity. The greater challenge is consistently delivering this fuel to sectors and categories where it is needed most — to recover dormant supply capacity rather than inflame already strained capacity (here and here and here and here). Mindful targeting matters, as usual.

If prices are too high right now, there is a solution. Reduce demand where supply capacity is insufficient and increase demand where supply capacity is available.

+++

February 8 Afterword: As previously noted, I have been very reluctant to give significant attention to the M2 money supply in my ongoing effort to understand Supply Chain Resilience. Measuring the money supply — especially the supply of US dollars — is like measuring raindrops. But given my perception of demand’s substantive influence on supply — and the recent extraordinary growth of M2 (even if imprecisely measured) — I have decided that ignoring M2 can no longer be justified. It is worth noting that I am working with the scope and scale of M2 to decipher the pull of demand on the supply chain’s push-capacity. I am not trying to claim or predict how M2 causes inflation. There is a difference between demand surges and swerves causing perturbations in the flow of goods and services and the role of M2 in the Consumer Price Index. Smart folks can disagree on how M2 and inflation are related (or not). In any case, discerning inflation, per se, is not my purpose. Discerning potential patterns — and especially preferential attachments — in the complex adaptive system of global flows of goods and services is my purpose. For my purposes, M2 is very rough but — especially given its recent behavior and enormous size — I hypothesize M2 does influence demand and, therefore, supply. I am still working through how, when, and why.