Speaking on September 10, the President of Ukraine said:

This will be the most difficult winter in the whole world… Russia is doing everything to break the resistance of Ukraine, the resistance of Europe and the world in 90 days of this winter. Because this is what Russia hopes for. This is its last argument. The last one, I am sure of it: the cruelty of the winter period, which is supposed to help when the cruelty of man is not enough. And we must be ready – not to break down, not to split, not to deviate from our path. There are 90 days ahead, which will be more crucial than 30 years of Ukraine’s independence. 90 days that will be more crucial than all the years of the existence of the European Union. Winter will determine our future and the risks.

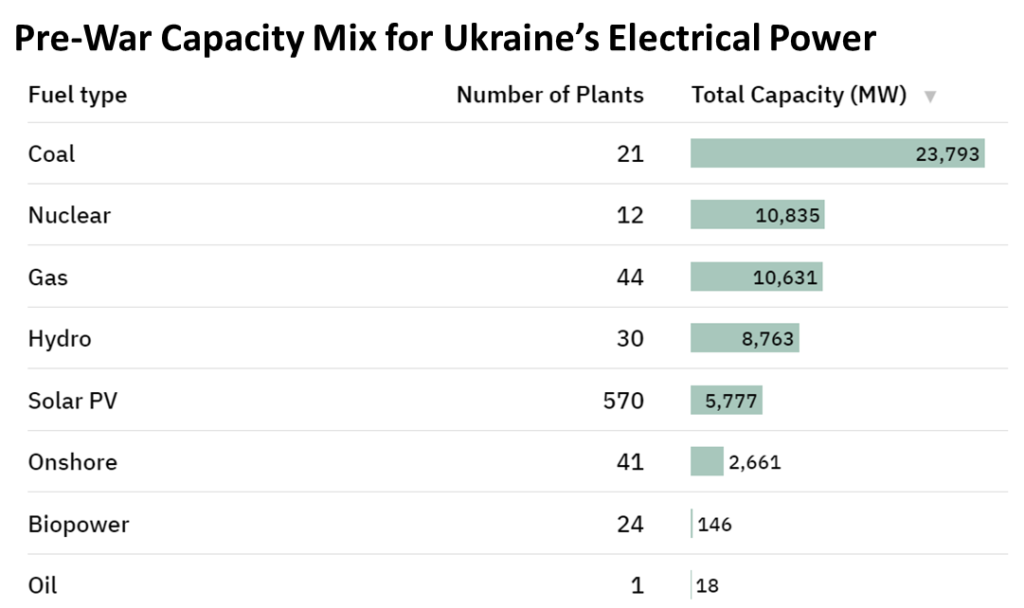

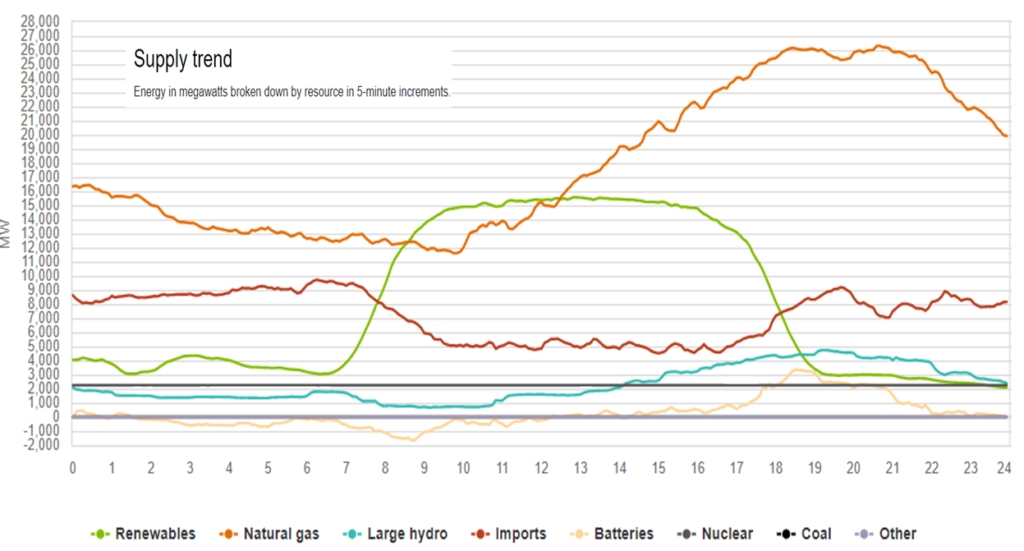

This week’s controlled shut down of the Zaporizhzhia Nuclear Power Plant reduces Ukraine’s grid capacity by 5700MW or almost one-tenth of the nation’s pre-war electric generation capacity (more and more).

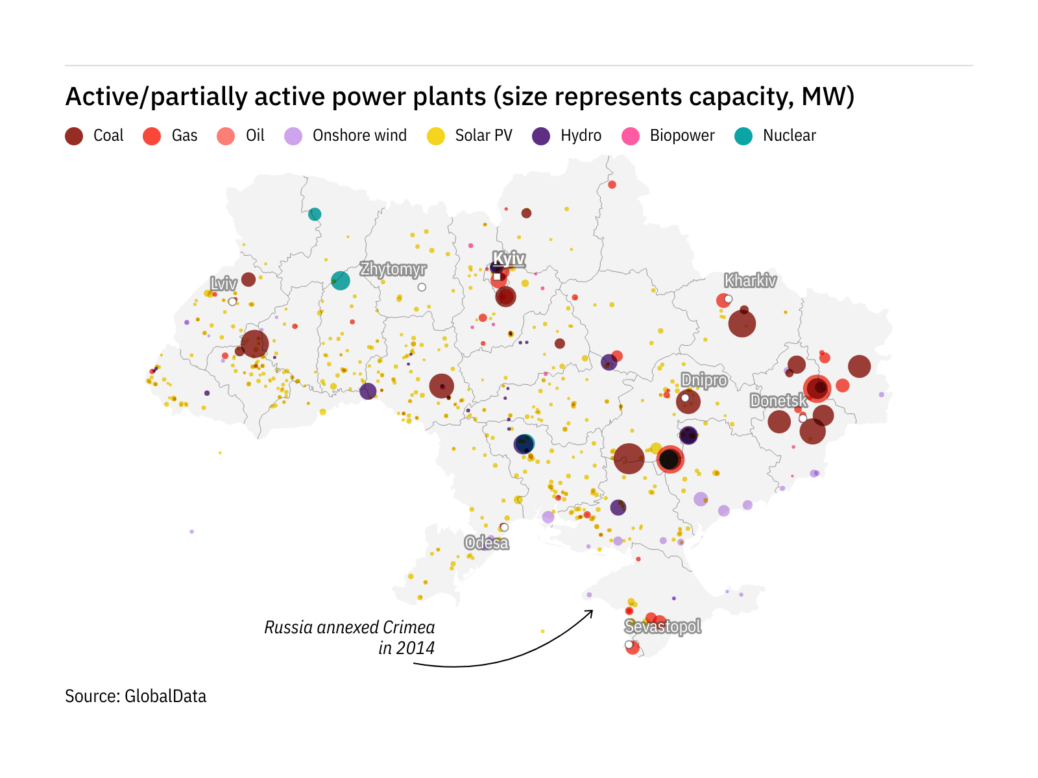

What Russian cyberattacks did not achieve is now being advanced through military actions and intimidation.

Earlier this week Euronews reported, “Russia has been accused of attacking power stations and other infrastructure in eastern Ukraine on Sunday, which caused widespread outages. The bombardment ignited a massive fire at a power station on Kharkiv’s western outskirts…” (more)

Forty-four natural gas-fired power plants contribute about 10,000MW to grid capacity. Ukraine’s natural gas storage facilities are less than one-quarter filled.

Coal stocks are, however, reportedly more than double 2021’s winter-ready inventory. Since June Ukraine has banned all coal and most energy-related exports. Twenty-one coal-fired plants constitute more than one-third of Ukraine’s grid power capacity. Coal-fired capacity can be maximized, but is not sufficient to replace lost nuclear or natural gas. Overall demand for electricity has fallen due to war-time economic disruptions. New capacity is being developed, but is unlikely to be available this winter.

Still, Ukraine apparently now has sufficient confidence in its coal-fired capacity that it may provide urgent support to neighboring Poland. While Poland is Europe’s largest coal producer and exporter, before the war Poland was also a major importer of cheap Russian coal (sell high, buy low). Since April Warsaw has banned imports of Russian coal and is now facing a significant shortfall in stocks needed for electric generation and household heating using lump coal (more and more and more).

Ukraine’s calculus seems to be: If our coal plants continue to operate, we have sufficient coal stocks and replacement flows to generate at capacity. We cannot use more coal than current capacity. If the Russians continue to attack our coal plants, we will not be able to fully utilize these coal inventories. Earlier this month, President Zelensky said, “We have sufficient volumes for ourselves and we can help our brothers to prepare for this winter.”