For tedious — even tendentious — reasons, I have resisted consistent attention to movement in the M2 money supply measure. In my mind (until now) M2 moved this supply chain guy too far from assessments of demand and supply and too deep into economic analysis. My supply chain competence is arguable. My economic expertise is execrable.

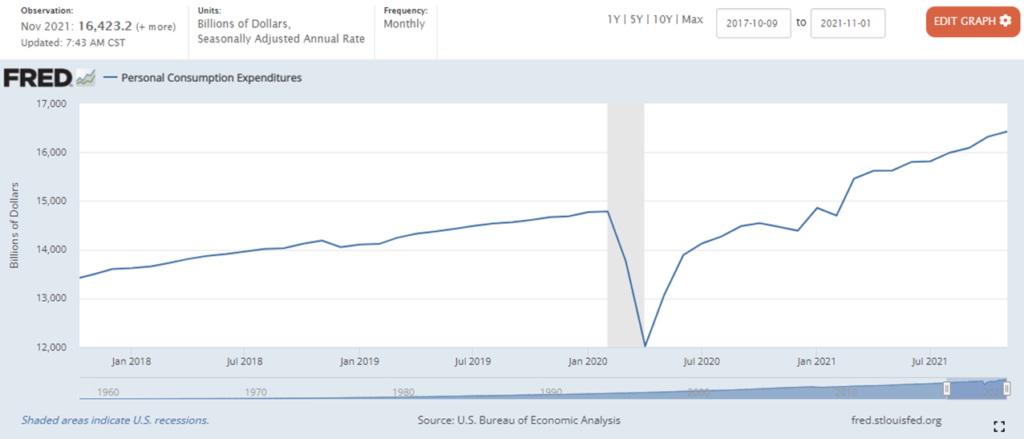

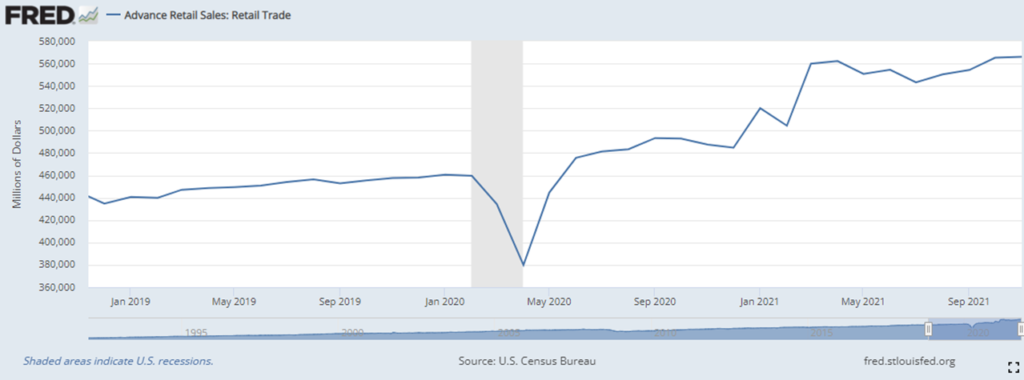

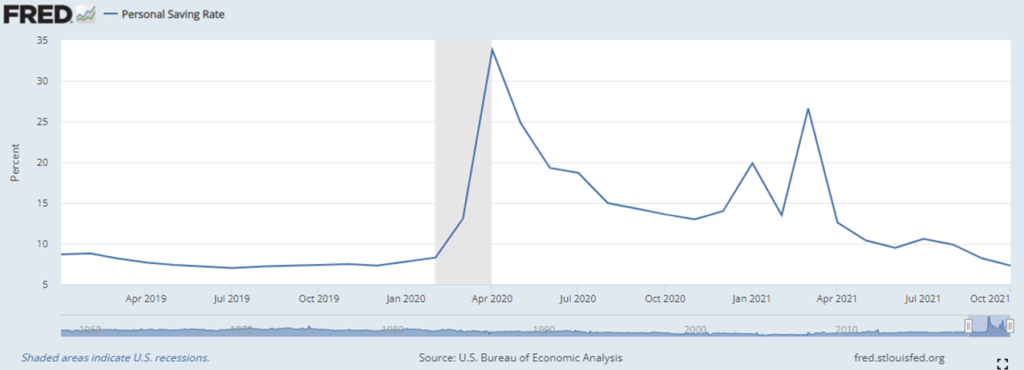

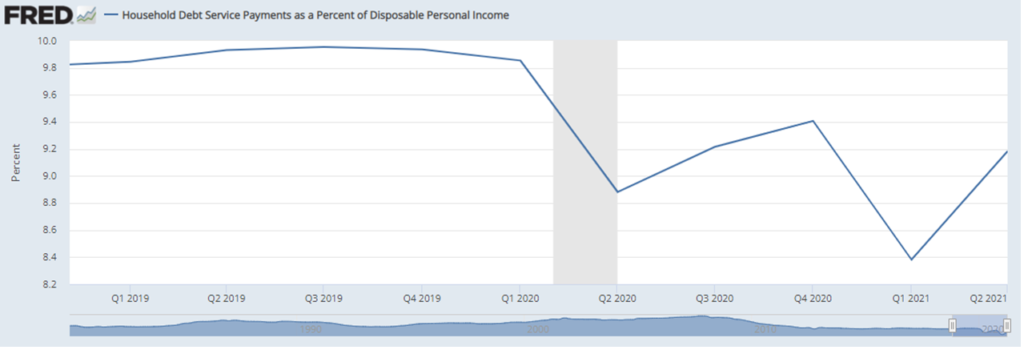

So, this conversation has given ongoing attention to retail sales and occasional attention to the personal saving rate and to debt payments as a percentage of disposable income. I will continue to monitor and report on these indicators. (Here’s a recent example.)

But, I have decided that even a supply chain guy must now embrace the M2 explosion and try to update my half-century old (pseudo-) understanding of classical monetary theory — and profound uncertainty regarding Modern Monetary Theory (and here and here). I take this step with real reluctance and even regret. But because high volume, high velocity supply chains self-organize around demand, the persistent increase and influence in M2 (see below) can no longer be neglected.

When M2 continued to grow despite strong holiday sales, I finally decided “attention must be paid” to M2 as a meaningful signal of how and when we may reclaim something closer to demand-supply equilibrium.

You will see me struggle. I welcome questions, corrections, clarifications, and even, when possible, confirmations.