Concentrated capacity is a key feature of contemporary demand and supply networks. Well-designed bottlenecks enhance the speed, accuracy, and cost-efficiency of flows. But beautiful bottlenecks can become troublesome chokepoints, especially when demand is volatile or exogenous impediments emerge (e.g., natural disasters, government interventions, war…)

Here are three current examples: 1) Black Sea grain flows, 2) Gulf of Cadiz LNG flows, and 3) San Pedro Bay off Los Angeles.

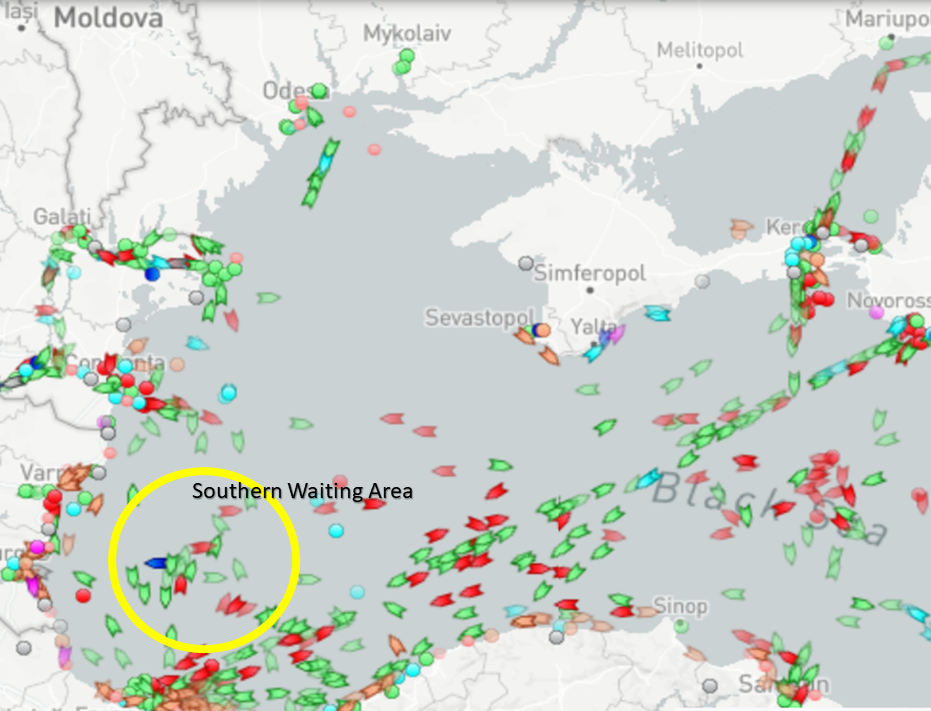

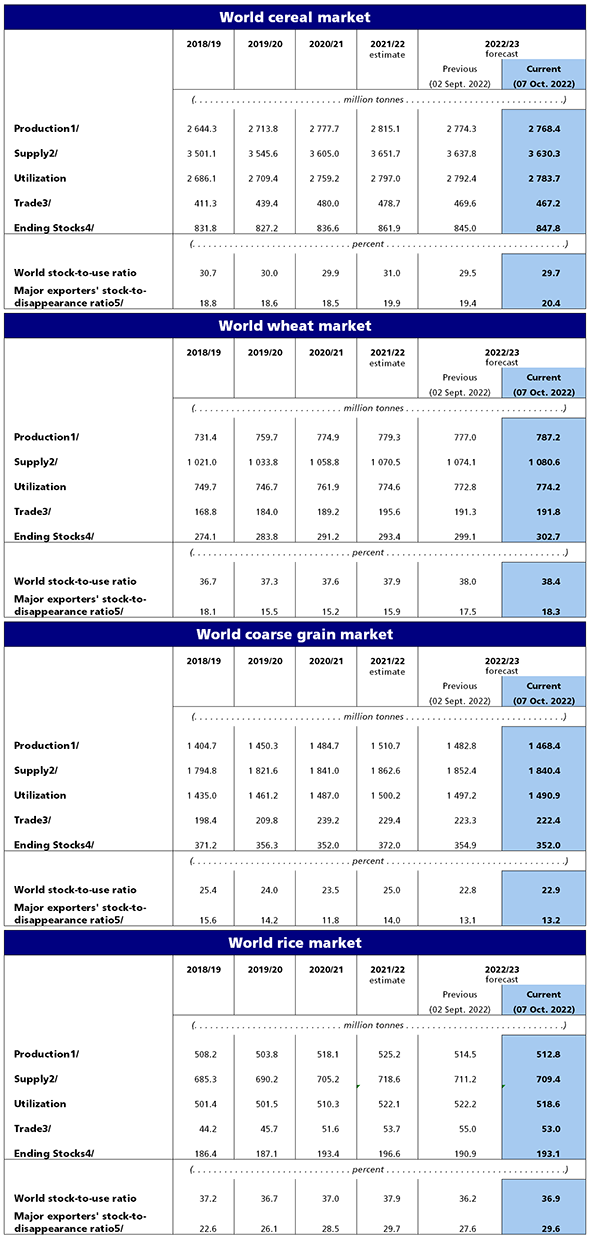

The Black Sea Grain Initiative has been much more successful than I expected. Sustained demand has not surprised me. Prices have been bouncy, but comparatively higher. The level of Russian cooperation has surprised me. The risk-readiness of grain carriers has also surprised me. In recent weeks Russian cooperation has ebbed even as world demand and carrier readiness has, if anything, escalated. The outcome, according to the United Nations, is “There are currently over 150 vessels waiting around Istanbul to move and these delays have the potential to cause disruptions to the supply chain and port operations.” (See map below.)

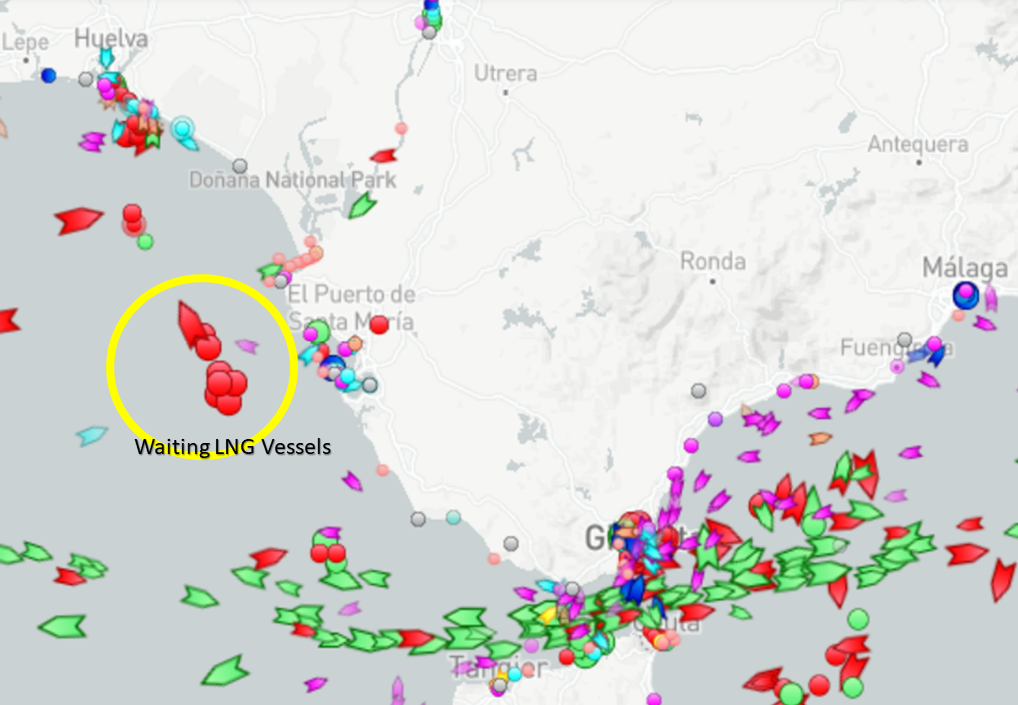

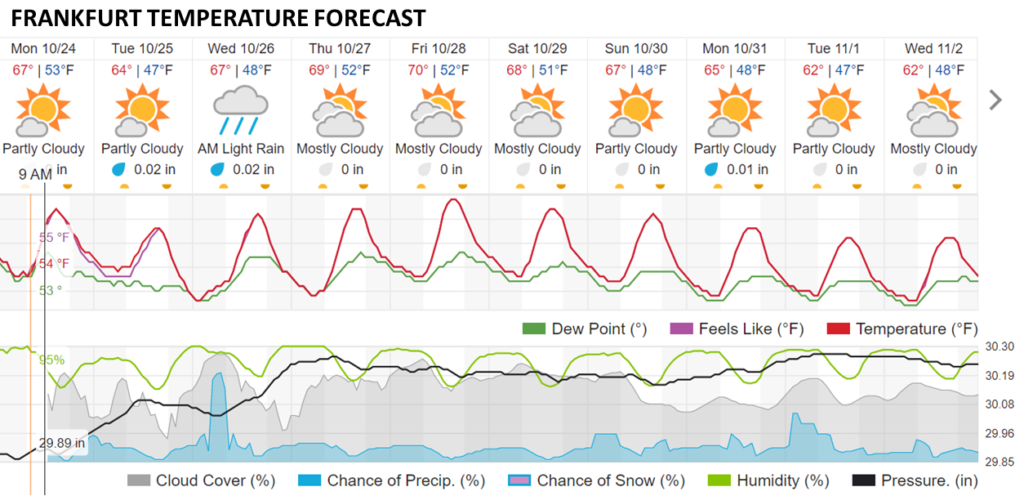

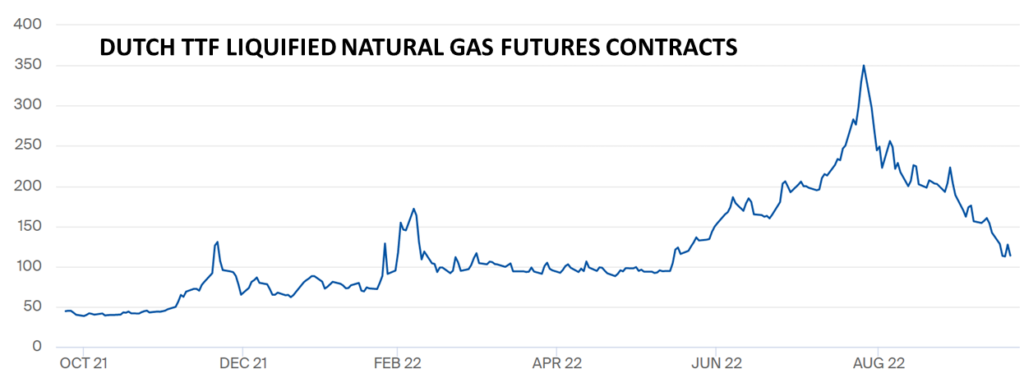

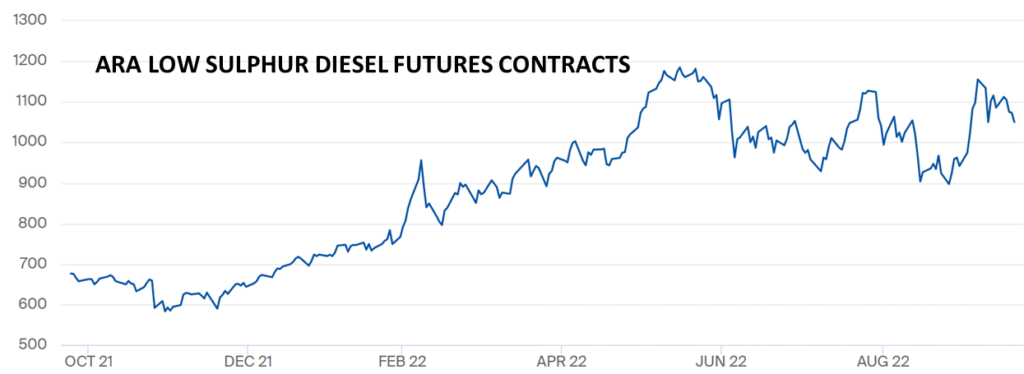

Strong demand to build European winter inventories of natural gas resulted in higher prices that attracted more flows. Recent warm weather has reduced typical demand for autumn residential heating and a combination of an economic slowdown and high prices has reduced industrial demand for energy. LNG prices have fallen. Sooo… according to Reuters and others, “several” LNG vessels are anchored or cycling off European LNG ports. (See map below) “They are waiting for higher prices. If one single idling vessel discharges its cargo, the price will immediately collapse by affecting the other cargoes on the queue and this domino effect is so painful in terms of opportunity cost.”

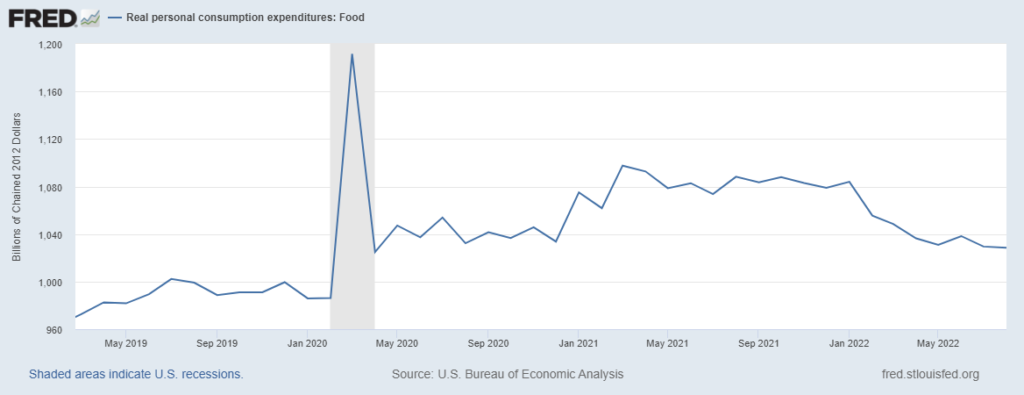

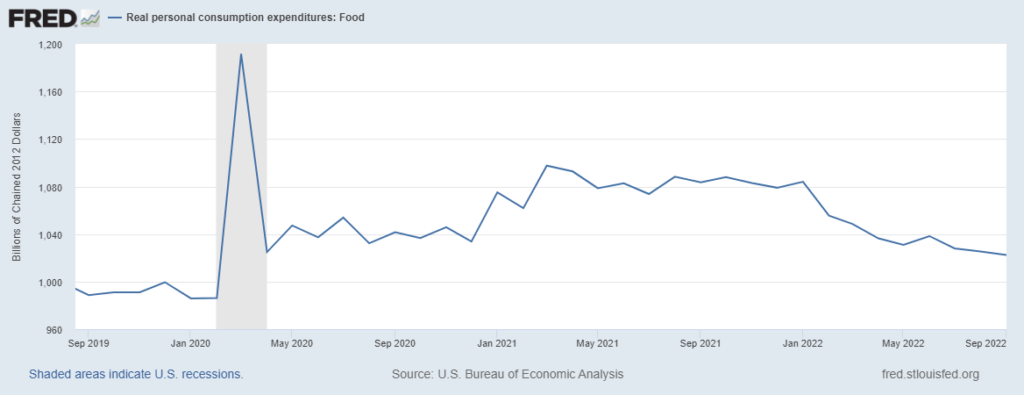

Meanwhile, last week the Wall Street Journal reported, “The backup of container ships off Southern California’s coast that was at the heart of U.S. supply chain congestion during the Covid-19 pandemic has effectively disappeared.” In January there were over one-hundred vessels waiting to dock at LA or Long Beach. More recent queues are in the single digits. The Journal explains, “U.S. import volumes are declining, according to trade data analysts, and a growing share of the shipments are heading to ports on the East and Gulf coasts as importers ship away from the Southern California backup.” Reduced demand (here and here) and agile velocity

Constraints on preexisting push cause price increases. Higher prices tend to pull more flow, which will increase congestion unless a way is found around the constraints or to fix the constraints. These three examples — at least so far — suggest that when 1) demand is more need-based than want-based and 2) need-based demand can be effectually expressed (when pull can afford to pay the price), that flow will find a way to connect supply with demand. Exceptions have been seen and can easily be imagined. But the power of pull should not be under-estimated.