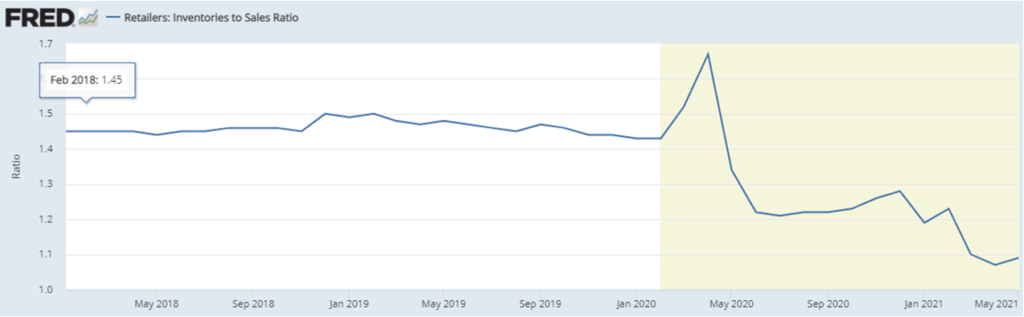

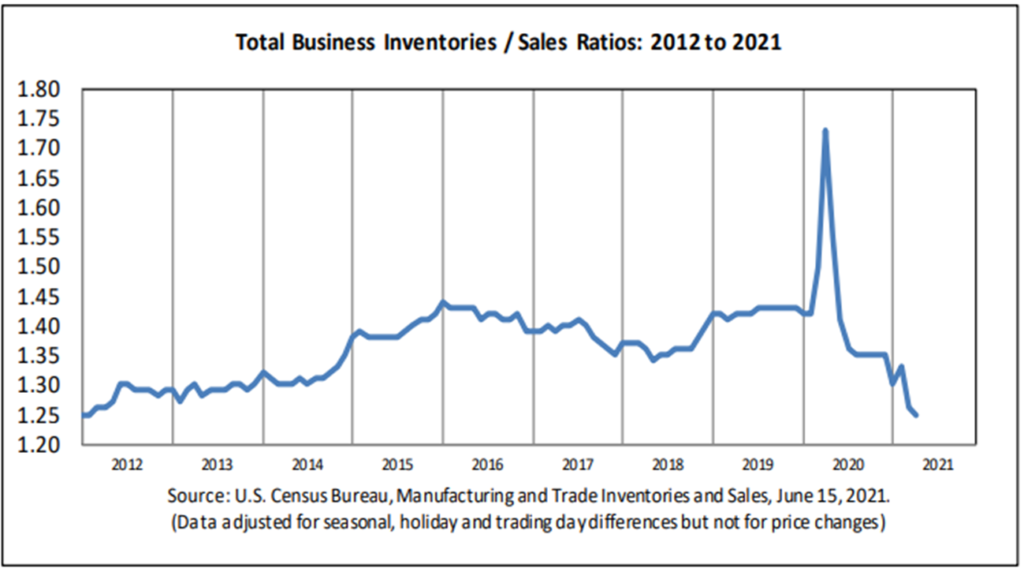

According to the US Census Bureau, for the first time since February inventories showed a slight improvement compared to sales. The ratio increased to 1.09 in May from 1.07 in April. Moderating May demand helped. But much tighter-than-normal inventories reflect several impediments to upstream capacity achieving pre-pandemic velocity (especially spatial/temporal accuracy). Dwell times and other freight delays have continued to increase. So, is this an ephemeral blip or the start of separating from an all-time bottom?