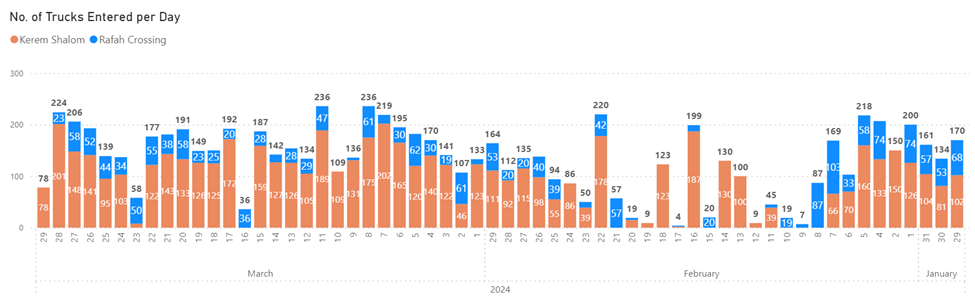

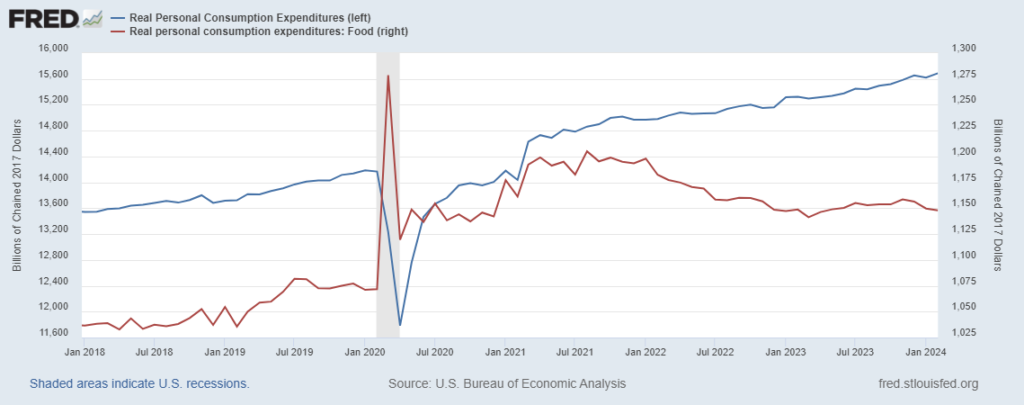

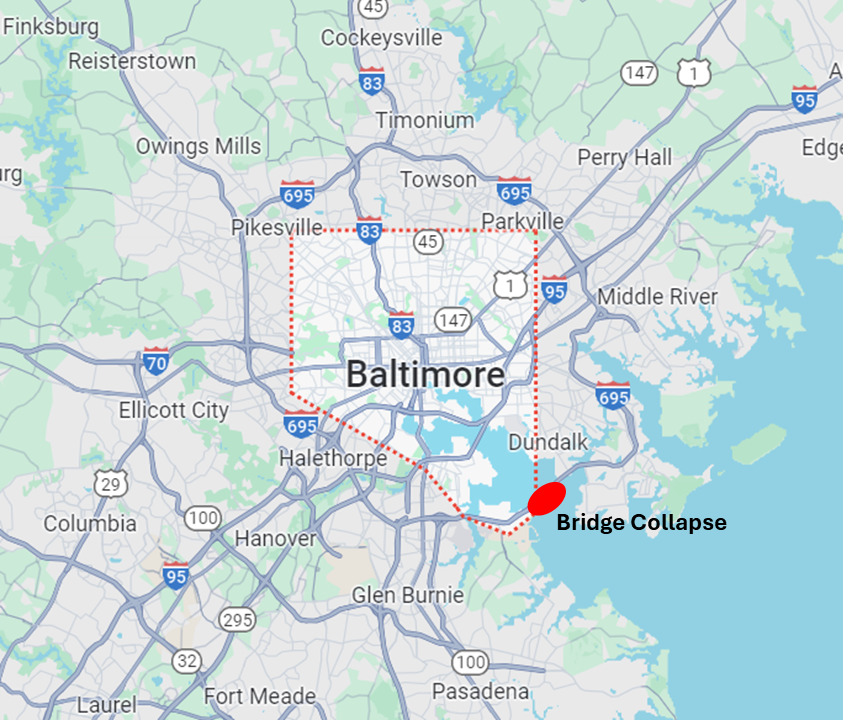

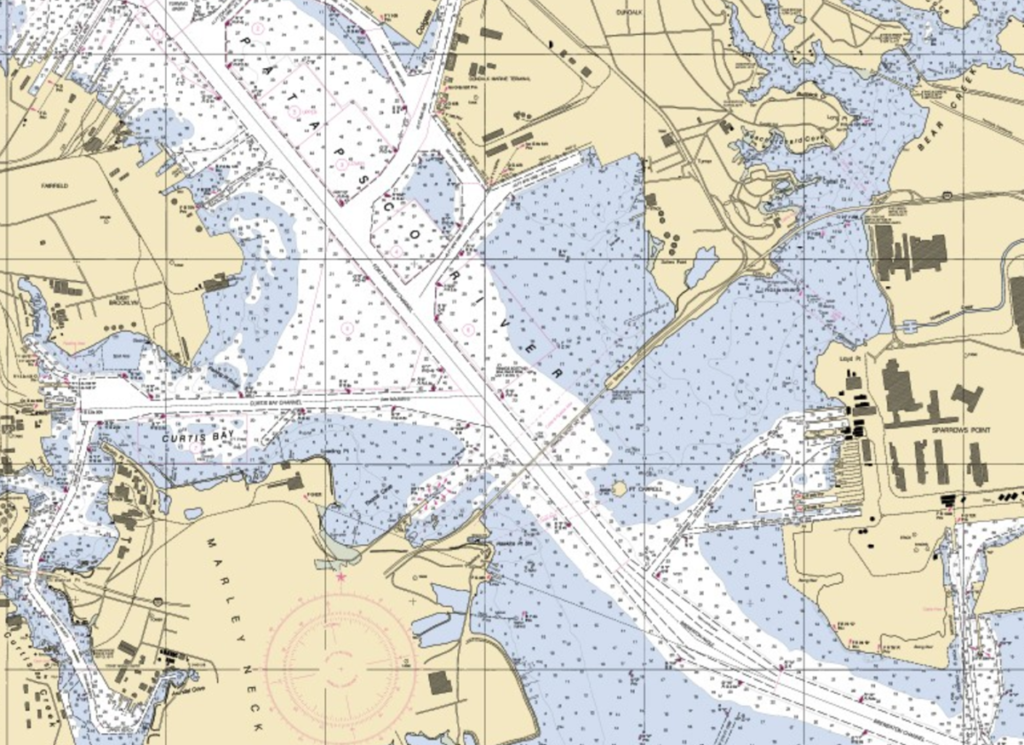

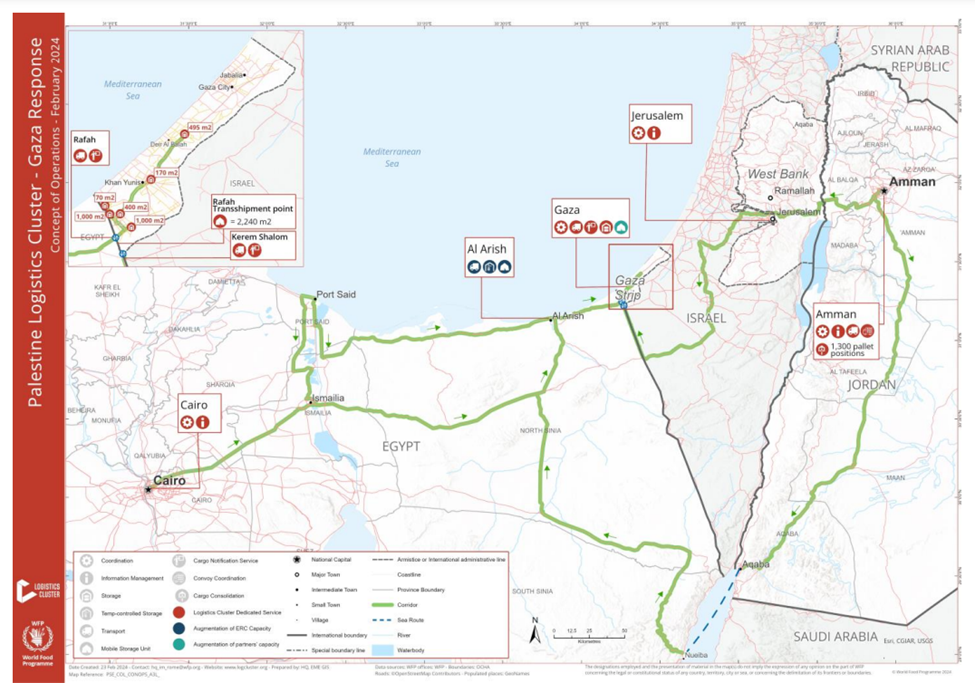

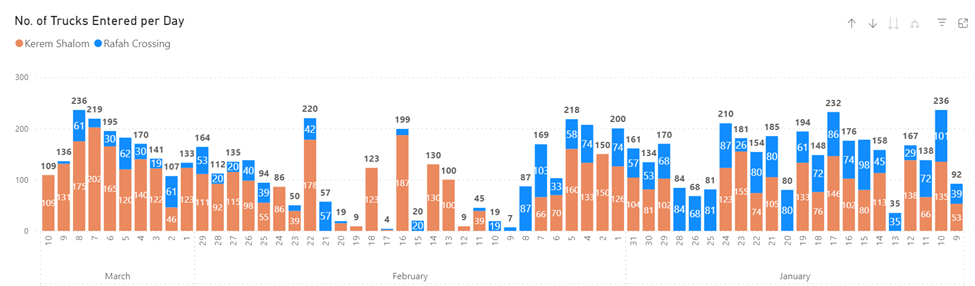

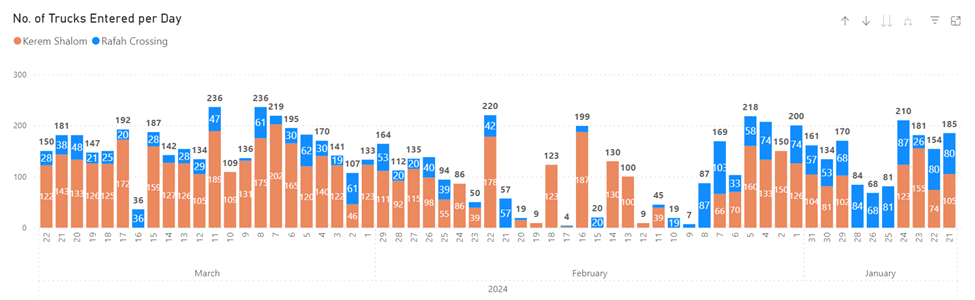

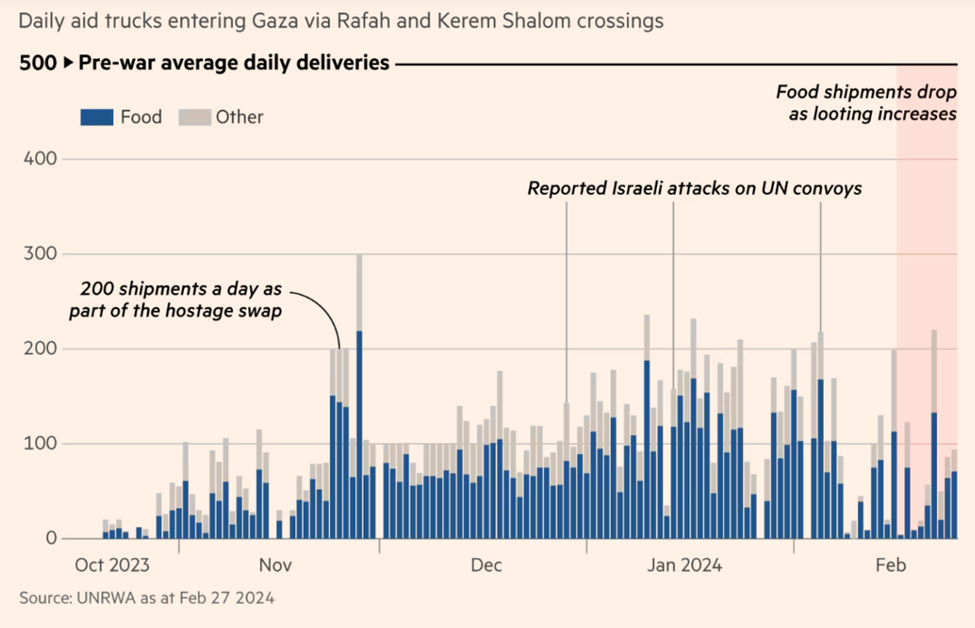

NBC News reviews persisting impediments for connecting demand (desperate need) to (plenty of) supply. Over the last week there has not been much change in actual flows since my March 24 update here (or for that matter since mid-December). Please see chart below. The Associated Press reports that, “A three-ship convoy left a port in Cyprus on Saturday with 400 tons of food and other supplies for Gaza as concerns about hunger in the territory soar. The World Central Kitchen charity said the vessels and a barge carried enough to prepare more than 1 million meals from items like rice, pasta, flour, legumes, canned vegetables and proteins. Also on board were dates, traditionally eaten to break the daily fast during the holy month of Ramadan. It was not clear when the ships would reach Gaza.” (More and more and more (and one more link from an April 1 WSJ report))

April 2 Update: The Washington Post reports, “World Central Kitchen said Tuesday that seven of its workers in Gaza were killed in an Israeli strike and that it was immediately halting its operations in the region.” Please read an April 3 essay by José Andrés, founder of World Central Kitchen, published by the New York Times.