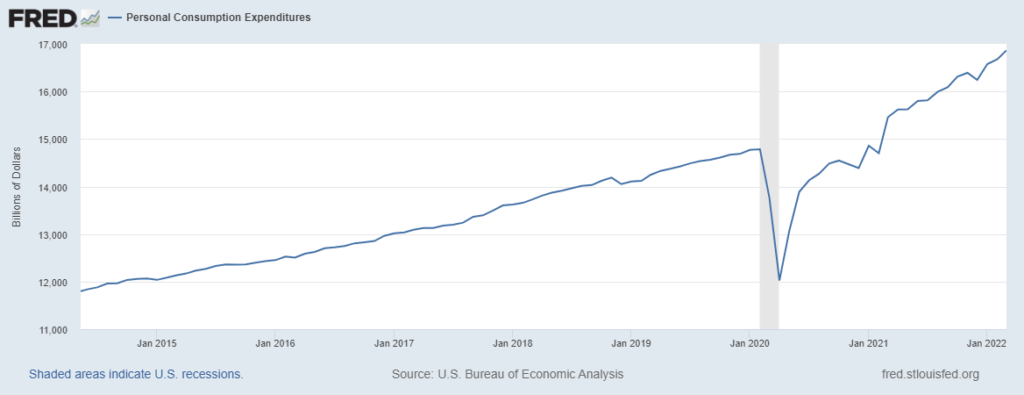

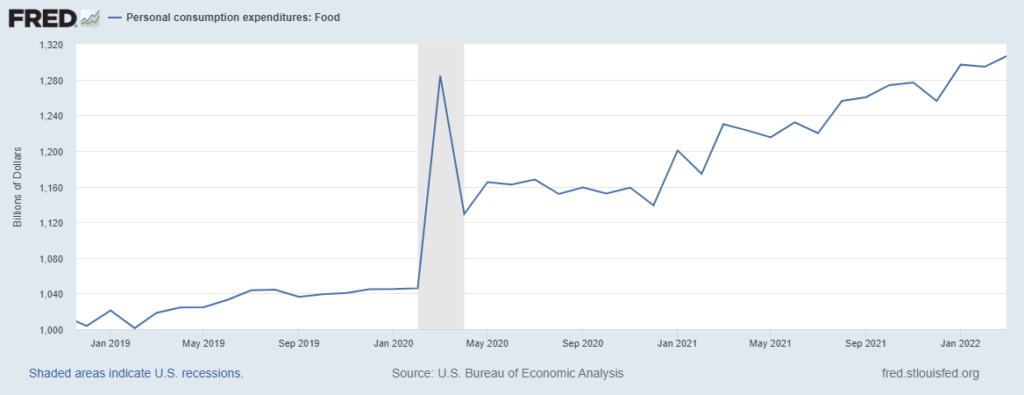

The report on April Personal Consumption Expenditures requires much more time than I can give it this morning. As the chart below indicates, American consumers continued to spend at unprecedented levels. And at least in April… the rate of increase seems to soften while what we buy continues to shift. Rebalancing? Reuters reported:

Goods spending increased a solid 0.8%, driven by new motor vehicles, clothing, footwear, recreational goods as well as furnishings and household equipment. Demand for goods remains strong even as spending on services is picking up. Services outlays rose 0.9% as consumers frequently dined out and traveled. There was also increased spending on housing and utilities, and recreation services… Personal income rose 0.4%, with wages accounting for the bulk of the increase. The saving rate dropped to 4.4%, the lowest since September 2008, from 5.0% in March. That suggests households have been tapping into the more than $2 trillion in excess savings accumulated during the COVID-19 pandemic. The reduction in savings could mean slower consumer spending down the road, especially given the rising borrowing costs.

Without the time to dig deeper into the data, I will offer a story — perhaps an analogy, suggesting a very imprecise hypothesis that will guide my eventual data review. As a junior in high school my football locker was next to one of the biggest, toughest tackles on the team. We were each changing after practice when the freshman quarterback appeared. Just his scrawny presence trespassed on varsity territory. Then, with pathological glee, this thin tiny boy-child purposefully goaded the 200 pound-plus offensive tackle to my right. I was not targeted, still the gratuitous harassment prompted my own bio-chemical reactions. The 6 foot something boy-man totally ignored the interruption.

But once the twerp had disappeared, my neighbor said to me: “I wish he weighed twenty pounds more so I could have smashed him to the floor.” Even at seventeen he understood the need for — and value of — symmetrical response. Given all the treacherous tensions impacting global flows of essential supplies (and the sometimes adolescent volatility of US demand patterns) it is easy to assume the worst and act accordingly. But I wonder if — hope that — there is a chance for some surprisingly mature self-restraint on spending that threads us through this explosive scrimmage between pull and push, demand and supply, inflation and recession.

This will seem a naïve or simply strange narrative for many readers. But in self-defense, it is possible to hear something similar emerging from the most recent CBO economic projections.

Next time: less narrative, more data… I promise.