Three bits this morning from Bloomberg. First, comments from the CEO of Albertsons. Bloomberg reporters add:

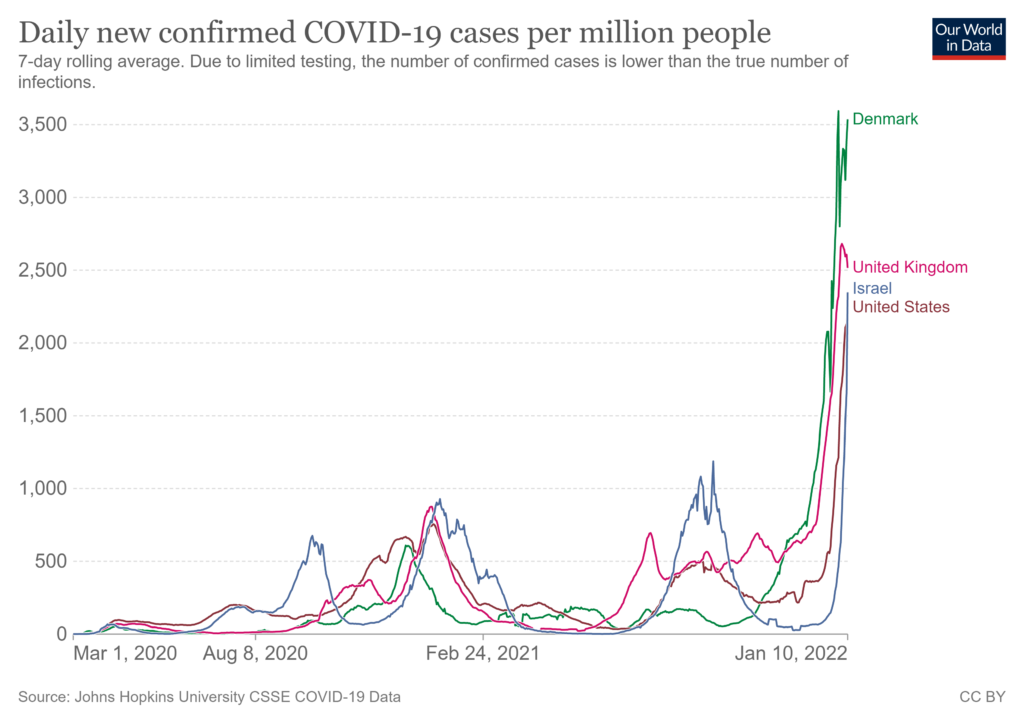

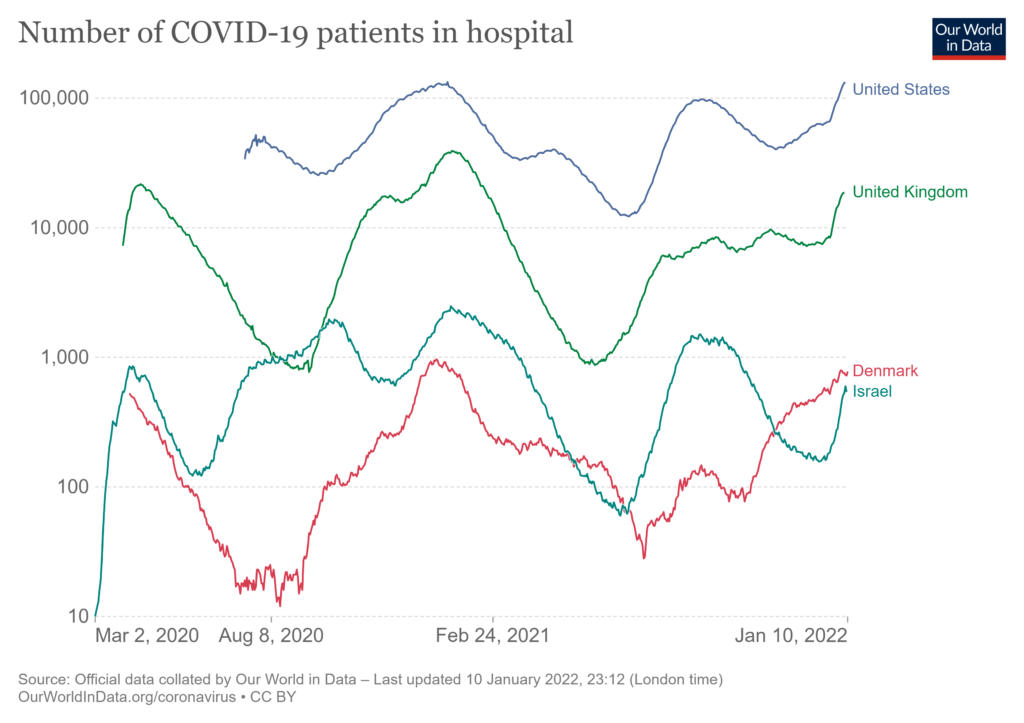

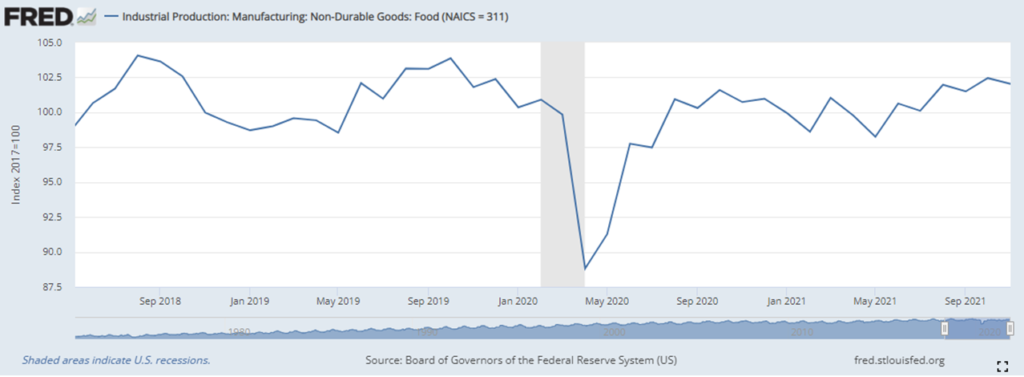

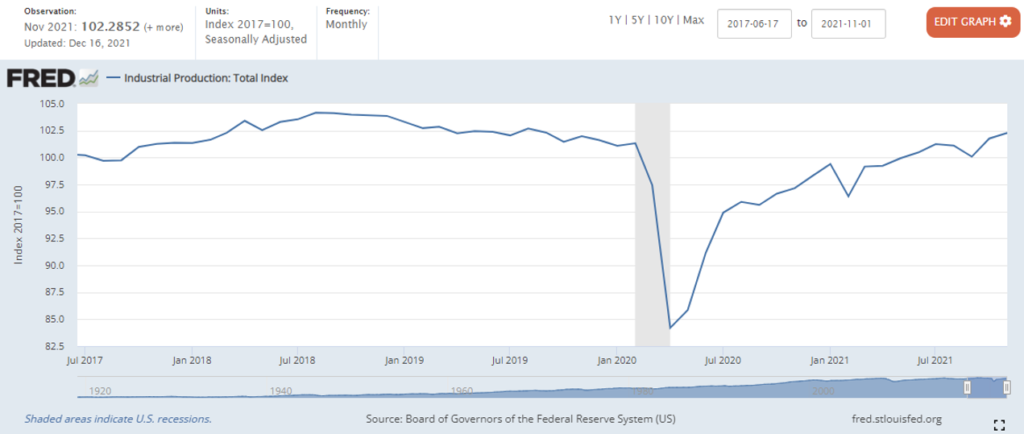

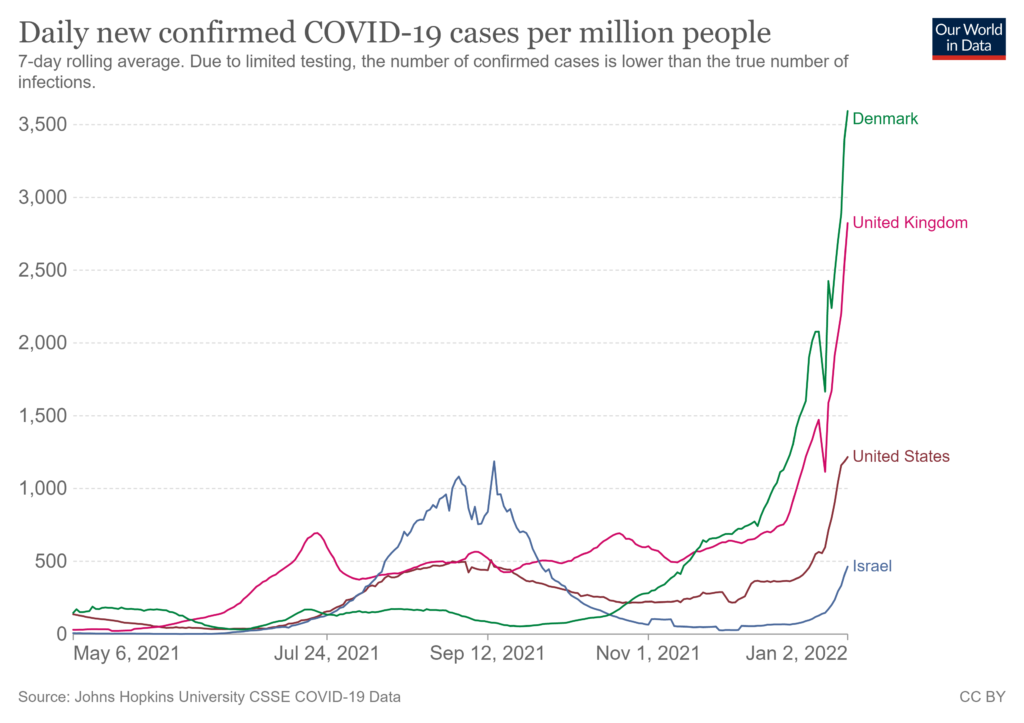

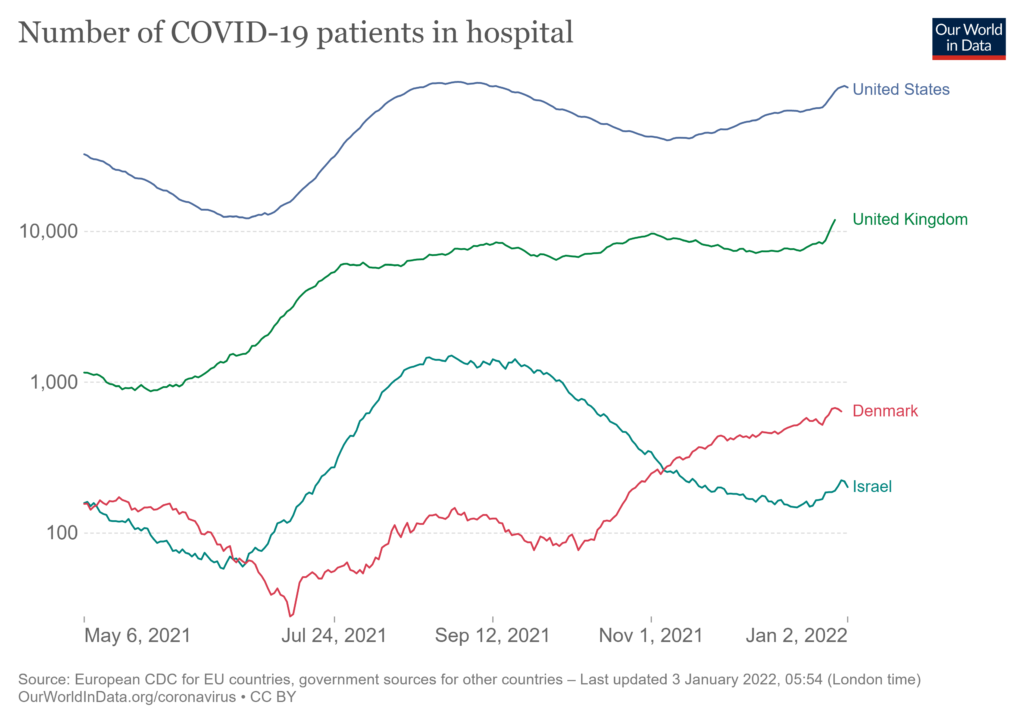

Omicron is exacerbating disruptions in food supply chains that are already stressed. Rising U.S. infections mean more workers are getting sick at farms, factories, distributors and retailers, crimping the flow of goods to shoppers just as the variant prompts people to eat at home more.

Australia is experiencing one-fifth (or worse) higher worker absenteeism, with specific impacts on the grocery supply chain.

With the virus now raging, a key industry body is warning that firms in food and logistics are reporting 10%-50% of their workers are sick or in isolation, leaving supermarket shelves empty.

Bloomberg has run some numbers on British workplace absenteeism. The proportion of workers not showing up spiked during the first week in January, consistent with what may have been UKs — or at least London’s — peak omicron period.

Both Brits and Aussies test a better proportion and have had better workplace compliance with isolation and quarantine policies than the USA. So, I would anticipate US absenteeism rates could be less severe. It is also interesting that British absenteeism in the logistics sector was lower last week than in the first week of 2021. The dire consequences of not delivering food and other crucial freight is recognized by workers. Logistics firms are proactive — even loss-leading — in trying to keep flows as strong as possible.

But given preexisting disequilibrium of demand and supply, it will not take much to deplete retail stocks and further slow replenishment. The Brits and Aussies are probably one to two weeks ahead of the USA in terms of peak omicron. So… the United States is probably at least one week out, maybe a bit more, from our most constrained flows of food and more. Different US regions will be on slightly different calendars with somewhat different outcomes. There will also be flow variation in product categories.

Here’s a US focused report from the Washington Post:

In a Monday call with 27 food industry chief executives, Geoff Freeman, CEO of the industry organization Consumer Brands Association, said more employee absences were reported in the past two weeks than in all of 2020.

We have been anticipating these results since early December. In my opinion it is not too soon to implement mitigation measures that include Hours-of-Service waivers, suspension of delivery curfews, and other local and regional adjustments that can increase potential velocity of available capacity over the next two or three weeks. It is important that truck stops and rest areas continue to be operational. Supply capacity will decline as absenteeism increases. Enhanced velocity can claw back some of what is lost.