On Thursday the US Bureau of Economic Analysis reported, “Personal income increased $233.7 billion (1.0 percent at a monthly rate) in January. Disposable personal income (DPI)—personal income less personal current taxes—increased $67.6 billion (0.3 percent). Personal outlays—the sum of personal consumption expenditures (PCE), personal interest payments, and personal current transfer payments—increased $54.3 billion (0.3 percent) and consumer spending increased $43.9 billion (0.2 percent). Personal saving was $779.3 billion and the personal saving rate—personal saving as a percentage of disposable personal income—was 3.8 percent in January.”

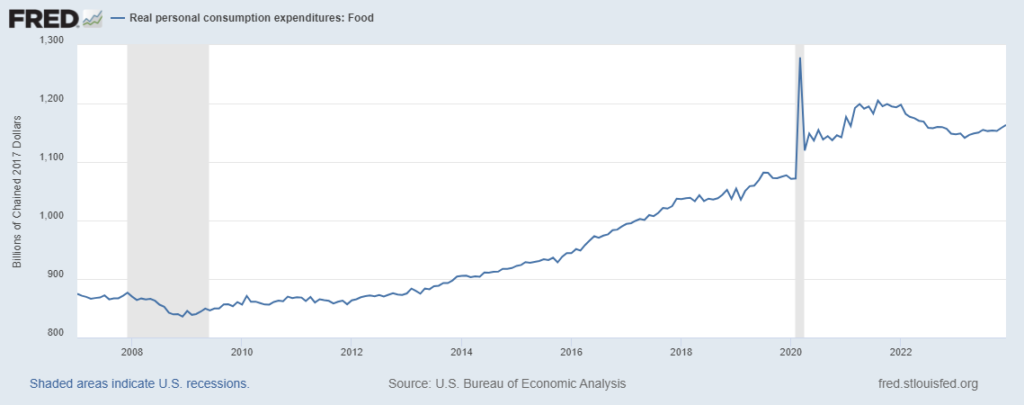

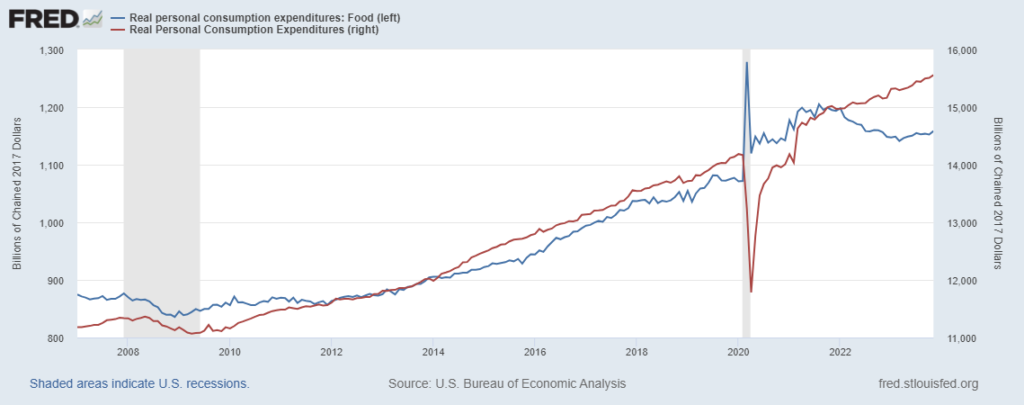

These are all nominal — current dollar — outputs. When reported in constant dollar terms (2017 chained value), the BEA finds, “The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.4 percent… Real DPI decreased less than 0.1 percent in January and real PCE decreased 0.1 percent; goods decreased 1.1 percent and services increased 0.4 percent…”

The economic implications — especially inflation-related implications — were summarized in this Bloomberg report:

The so-called core personal consumption expenditures price index, which strips out the volatile food and energy components, increased 0.4% from December, data out Thursday showed. From a year ago, it advanced 2.8%. Economists consider this to be a better gauge of underlying inflation than the overall index. Inflation-adjusted consumer spending dropped for the first time in five months after a robust holiday shopping season, according to the report from the Bureau of Economic Analysis. Real disposable income, the main supporter of spending, was little changed.

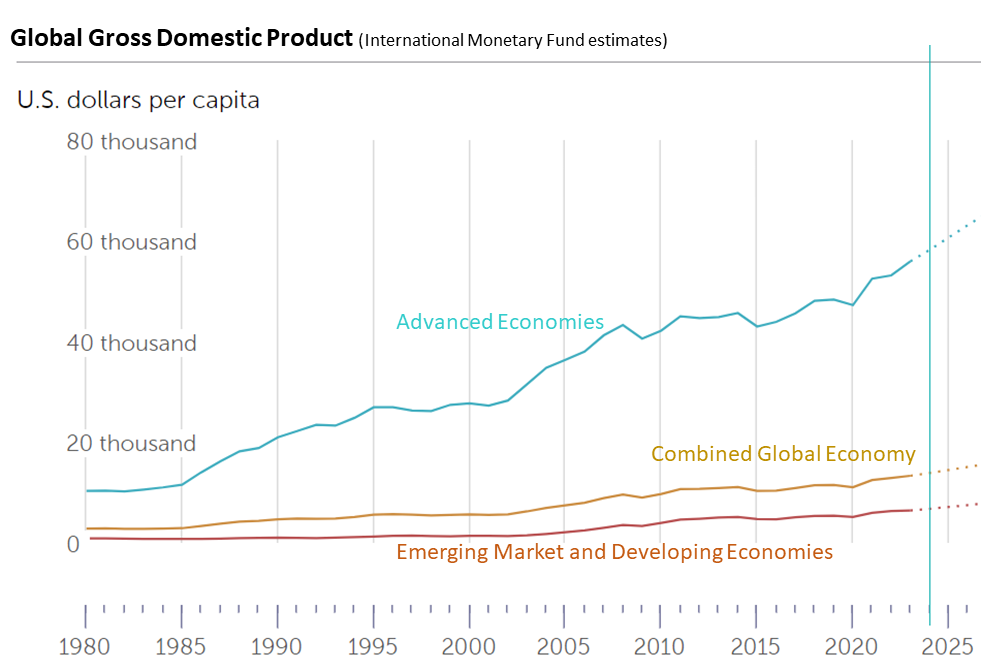

From a supply chain — pull-push — perspective, I tend to give extra attention to housing, food, and fuel consumption. Supply chains are sensitive and can be stressed by significant and, especially, any rapid changes in pull (as seen below in pandemic behavior). These are three categories that provide a snap-shot of supply chain fitness for core human needs.

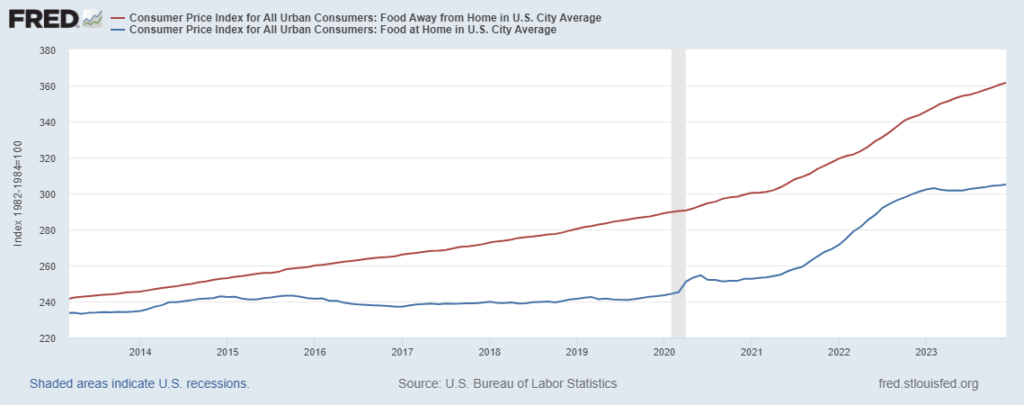

High volume, high velocity supply chains are better able to ensure demand-fulfilling flow when there is predictably stable or incremental increases in demand. Below are the inflation adjusted personal consumption expenditures for existing housing and utilities (top red line), Food-at-Home (middle blue line) and gasoline and other energy goods (bottom green line). After significant disruptions in the first half of 2020, big picture demand shifts and rate of change have been mostly benign to positive for balancing push and pull for existing housing, food, and fuel. (Not-so-much for new housing, some rents, and eating-out.)

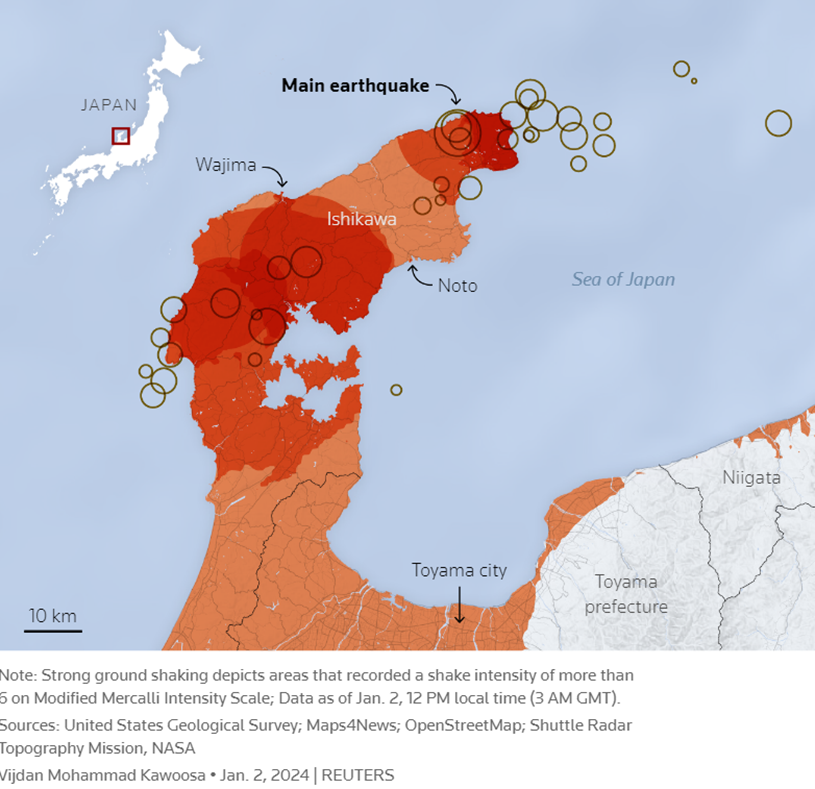

The general strength of consumer demand in the United States is in marked contrast to behavior in China (here and here), much of the European Union (here and here), and Japan (here and here).

Note: Real PCE — inflation adjusted — outcomes for gasoline and housing are only generated on a quarterly basis, hence the unfinished lines above. But there is no reason to expect sudden arcs up or down since the end of the 2023 Fourth Quarter.