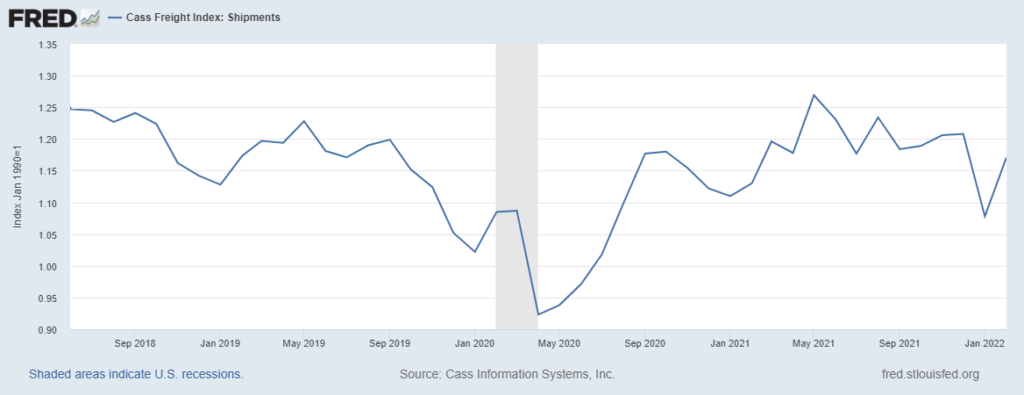

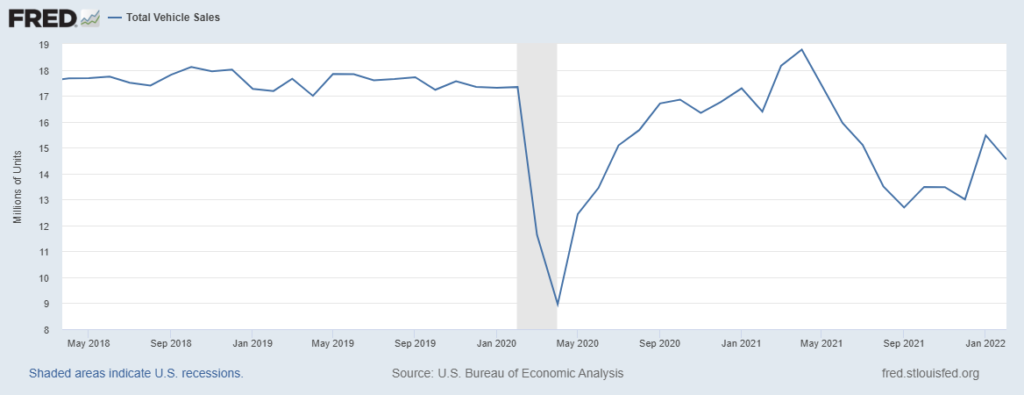

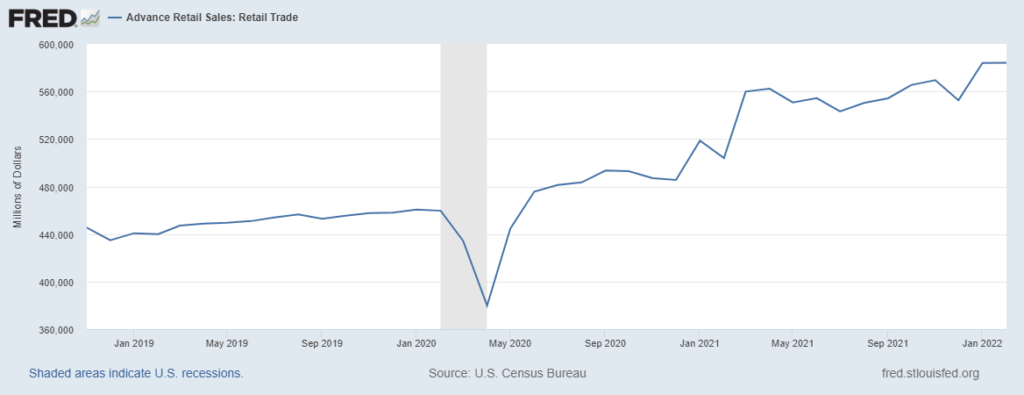

Yesterday’s release by the Bureau of Economic Analysis on February Personal Income and Outlays includes good news for supply chains. Overall personal expenditures increased slightly, from $16,678 billion in January to $16,713 billion in February. Considering inflation, this implies a potential reduction in product flow. This potential seems to be confirmed by a 2.5 percent decline in durable goods expenditures compared to (an admittedly high) January pull signal. Meanwhile expenditures on services continued to increase and are now above pre-pandemic levels. Almost two years of intense demand for durable goods is dissipating as other consumption channels become more available (and, perhaps, as inflation-influenced prices encourage alternatives). In late December and early January we saw a decline in flow that was precipitous enough to cause concern. But even before yesterday’s numbers, we had seen February freight volumes recover a more sustainable level (see chart below, March 14 release for February). The demand patterns in yesterday’s report reinforce this sense of improving equilibrium between pull and push. This was the flow context just before the war in Ukraine spiked fuel prices and introduced significant uncertainty into flows of key agricultural products and strategic minerals. The lock-downs in Hong Kong, Shenzhen, Shanghai, and elsewhere have since contributed their own ebbs and flows. We continue to ride some rapids. Class III or even more exciting?