Los puentes colgantes by Federico García Lorca

Oh qué gran muchedumbre,

invisible y renovada,

la que viene a este jardín

a descabsar para siempre!

Cada paso en la Tierra

nos lleva a un mundo nuevo.

Cada pie lo apoyamos

sobre un puente colgante.

Comprendo que no existe

el camino derecho –

Sólo un gran laberinto

de encrucijadas múltiples.

Constantemente crean

nuestros pies al andar

inmensos abanicos

de senderos en germen.

Oh jardín de las blancas

teorías! Oh jardín

de lo que no soy pero

pude y debi haber sido!

Floating Bridges

Oh what a crush of people

invisible reborn

make their way to into this garden

for their eternal rest!

Every step we take on earth

brings us to a new world.

Every foot supported

on a floating bridge.

I know there is no straight road

no straight road in this world.

Only a giant labyrinth

of intersecting crossroads.

And steadily our feet

keep walking and creating

like enormous fans

these roads in embryo.

Oh garden of white

theories! Oh garden

of all I am not, all I

could & should have been!

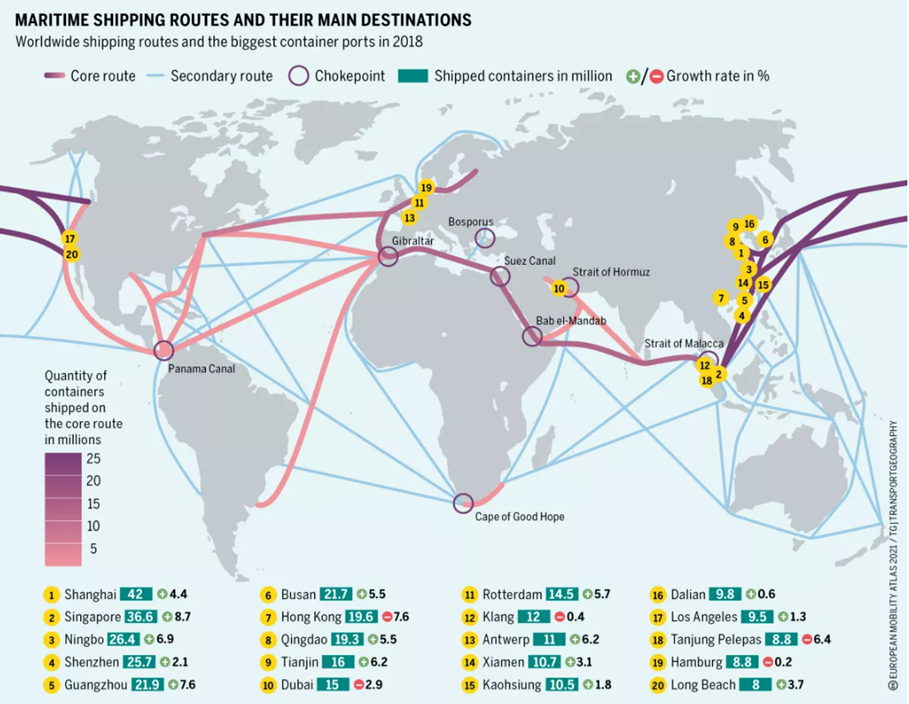

The poem is by Federico García Lorca the great Spanish — Andalusian — poet. The photo is of a “floating bridge” over the Almanchares River between Sedella and Canillas de Aceituno, along the ancient spring-fed waterways so crucial to this region. Surely I am not the only Supply Chain or related person who perceives our daily context in these verses. This is where we step. This is why we go. This is how we flow along these intersecting crossroads, giving what we can, making our way in this world, and even unto the next.

כִּי-הִנְנִי מֵבִיא אֶת-עַבְדִּי, צֶמַח.