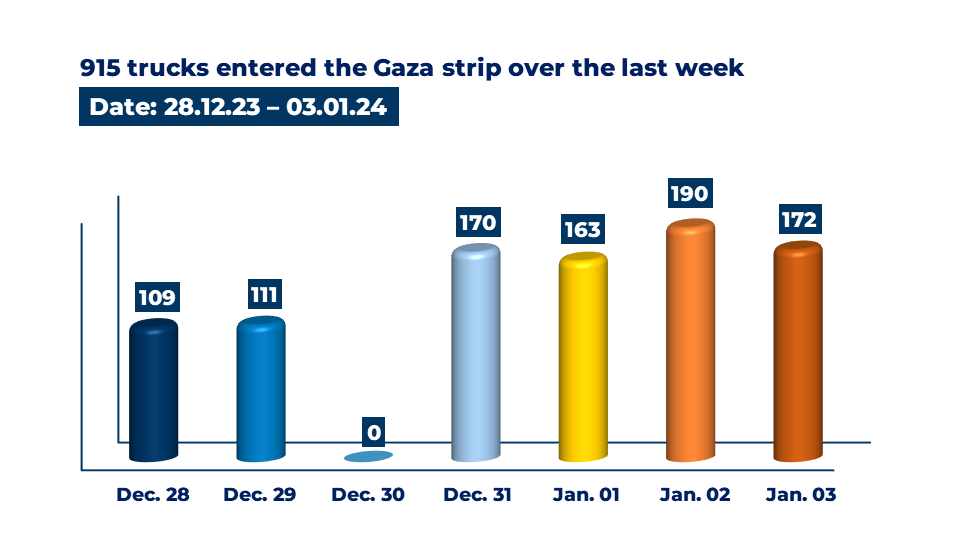

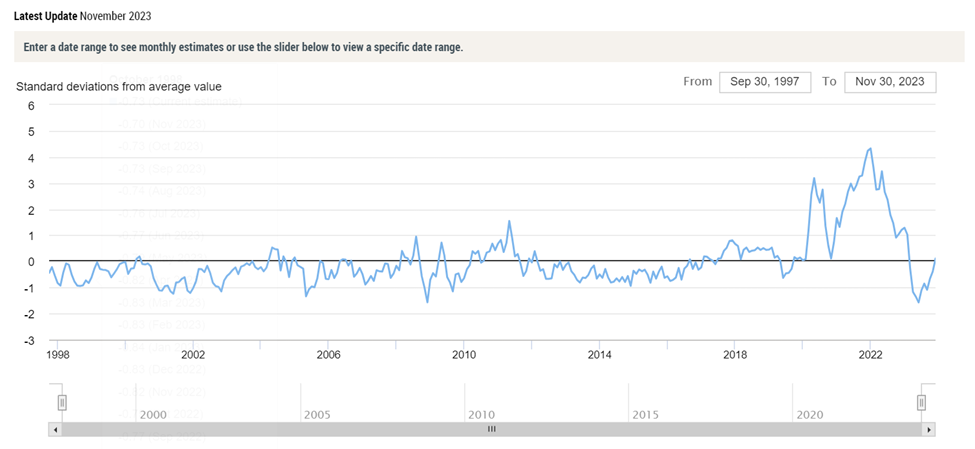

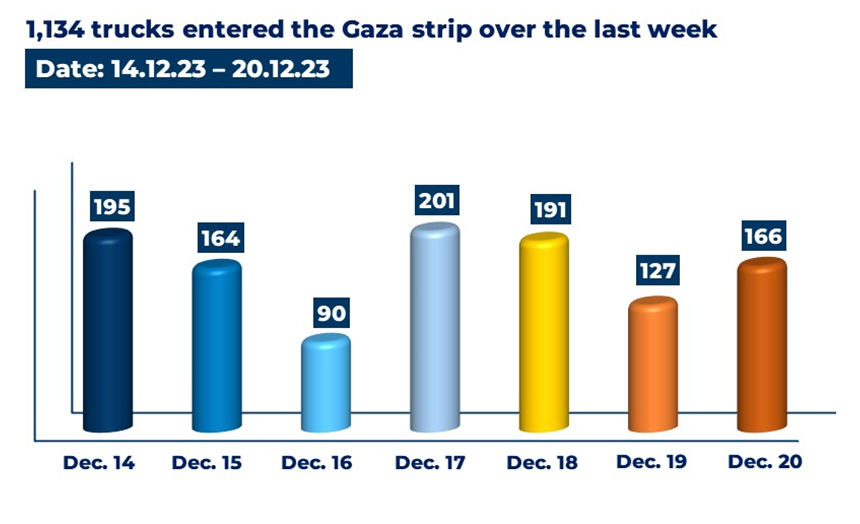

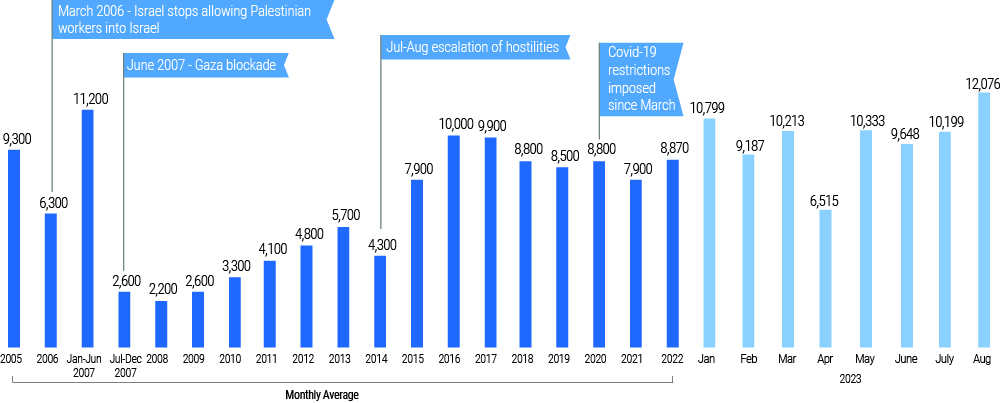

Supply chain outcomes for the residents of Gaza have continued to deteriorate. Volumes discharged into Gaza remain well below the minimum needed 200 truckloads per day. (See chart below).

The Kerem Shalom Crossing has resumed operations. According to COGAT, “A total of 163 trucks carrying humanitarian aid, including food, water, medical supplies, and shelter equipment were inspected and transferred to the Gaza Strip yesterday (Jan. 1). 87 trucks inspected at Nitzana crossing and transferred to the Gaza Strip via the Rafah Crossing, and 76 trucks inspected and transferred to Gaza via Kerem Shalom. “

Delivery velocity inside Gaza is next to nil. According to the most recent LogCluster consultation (December 28), “There is no last mile delivery or transportation to specific locations by the Logistics Cluster as every movement of transport requires deconfliction.” There have been other attempts to make deliveries, these have often failed due to military operations or civil unrest (more and more).

On December 30 CNN reported, “In recent days, crowds of civilians desperate for food have been seen surrounding aid trucks coming into Gaza. The United Nations has warned that the humanitarian situation in southern Gaza is deteriorating and warned that the volume of aid entering the enclave “remains woefully inadequate.”…An IPC report the same week found that approximately all of Gaza’s 2.2 million residents are now facing acute hunger and the entire population of the Gaza Strip is classified in a state of crisis – the highest share of people facing catastrophic levels of acute food insecurity that the IPC initiative has ever classified.” Famine conditions have been predicted by February at the latest.

As previously explained, prior to October 7 food stocks in Gaza were much more robust than is typical of more market-oriented dense urban areas. During the November 24-30 pause in hostilities food flows mostly met the 200 truckload per day minimum. Food stocks have since fallen precipitously and are not being replenished. The opening of the Karem Shalom Crossing on December 16-17 was promising. This was the principal freight entry facility before October 7. But this restored potential has prompted no discernable improvement in either inbound volume or outbound velocity.

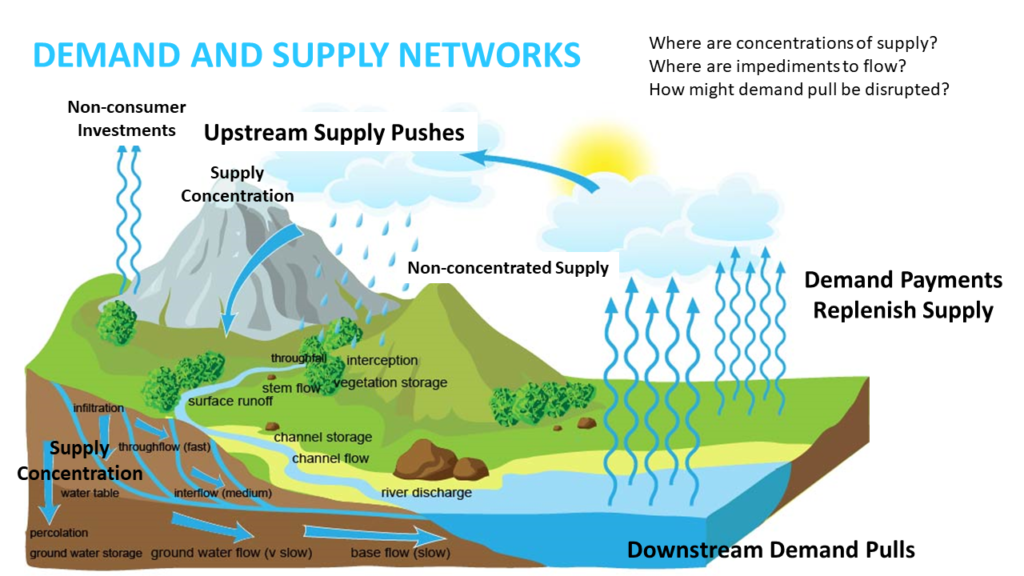

Upstream supply is immediately available, according to LogCluster reports 3,000 aid trucks are currently near the Al Arish port (Egypt) waiting to enter Gaza. Another 500 trucks are said to be waiting farther west at Port Said.

In catastrophic contexts supply chains are almost always caught in a narrow place between what is prudent and what is imprudently possible (and failure may be probable). From this distance, I recognize the painful pinch. I am not ready to second-guess decisions made by those whose lives are wedged in this tightly constricted time and space. In any case, each day the deadly consequences sharpen and accumulate.

+++

January 4 Update: LogCluster has posted an overview of Gaza operations through December 18 -31. The New Yorker has interviewed the Chief Economist for the World Food Program (WFP). One summary quote, “Gaza needs more food coming in. On a good day, aid groups are bringing in maybe twenty-five to thirty per cent of what they need. So, obviously, a lot more food, fuel, medicine, water need to come in. But they need to be distributed as well. They need to go to where the people are. And I don’t know how you can do that without a humanitarian ceasefire.” COGAT reports that on January 3, “Flour, sugar, salt and fuel were distributed by WFP to bakeries in the Gaza Strip. As a result, 10 bakeries resumed operations last night. Equipment for 4 WFP warehouses have entered the Gaza Strip. These warehouses are expected to be set up in the coming days and will better the logistic capacity of the organizations receiving the humanitarian aid in the Gaza Strip.”

January 5 Update: 205 truckloads were delivered into Gaza on Thursday, January 4. (More)

January 6 Update: 151 truckloads were delivered into Gaza on Friday, January 5. (More and more and more and more)

January 8 Update: 198 truckloads were delivered into Gaza on Sunday, January 7. 113 of the trucks carried food, the rest carried water, medical supplies and shelter equipment. The Palestine Red Crescent Society provides an updated operational report through January 5. (More and more and more)

January 9 Update: I am receiving conflicting information on the number of truckloads that were delivered yesterday. This has happened once before and was resolved within about one week. LogCluster has provided details on the Kerem Shalom inspection and delivery process. Following is a summary from minutes of a January 4 meeting.

- Manifested trucks cross from Egypt to the scanning area at Kerem Shalom. The scanning capacity is still unclear.

- Once cargo is scanned, all cargo is offloaded in the designated area and trucks return to Egypt.

- A Palestinian private transportation company loads cargo from the offloading area of Kerem Shalom to a designated offloading area for UN and INGO cargo. There is a nearby offloading area for ERC/PRCS and NGO cargo arriving from Nitzana.

- When all cargo is offloaded, another truck loads the cargo and transports it to the Rafah transshipment point waiting area with a capacity of 50 trucks.

- The convoy of trucks at the Rafah transshipment point is dispatched to various locations (Rafah, Deir al Balah, Khan Yunis, etc.).

Cargo that arrives on one truck from Egypt may be divided into different trucks when transported from Kerem Shalom to the offloading area of UN and INGO cargo. The QR code placed on Egyptian trucks is not accessible once cargo has been offloaded at Kerem Shalom after scanning, as the trucks return to Egypt and cargo is loaded onto Palestinian trucks.

Several why questions are prompted. This process clearly has several internal friction points and tight constraints… even before dealing with the complications of a huge displaced population in a war zone.

January 10 Update: 182 trucks carrying humanitarian aid, including food, water, medical supplies, and shelter equipment were inspected and transferred to the Gaza Strip yesterday (Jan. 9). 80 trucks inspected at Nitzana crossing and transferred to the Gaza Strip via the Rafah Crossing, and 102 trucks inspected and transferred to Gaza via Kerem Shalom. 153 (84%) of the trucks carried food, the rest carried water, medical supplies and shelter equipment. (More)

January 11 Update: 208 trucks carrying humanitarian aid, including food, water, medical supplies, and shelter equipment were inspected and transferred to the Gaza Strip yesterday (Jan. 10). 89 trucks inspected at Nitzana crossing and transferred to the Gaza Strip via the Rafah Crossing, and 119 trucks inspected and transferred to Gaza via Kerem Shalom.144 (70%) of the trucks carried food, the rest carried water, medical supplies and shelter equipment. (More and more and more and more.)

January 12 Update: 201 trucks carrying humanitarian aid, including food, water, medical supplies, and shelter equipment were inspected and transferred to the Gaza Strip yesterday (Jan. 11). 84 trucks inspected at Nitzana crossing and transferred to the Gaza Strip via the Rafah Crossing, and 117 trucks inspected and transferred to Gaza via Kerem Shalom. (More and more and more.)

January 13 Update: According to OCHA: “On 12 January, 178 trucks with food, medicine and other supplies entered the Gaza Strip through the Rafah and Kerem Shalom crossings. Under-Secretary-General for Humanitarian Affairs and Emergency Relief Coordinator Griffith’s stated today that… “We cannot replace Gaza’s commercial sector. Commercial goods must be let in, at scale.” The minutes of the January 11 LogCluster meeting are now available. A few interesting excerpts: “Two additional Mobile Storage Units (MSUs) have been installed in Rafah to augment the storage capacity of the Palestine Red Crescent Society (PRCS). Two MSUs will also be installed in the coming days at Kerem Shalom to increase the offloading capacity. The Logistics Cluster plans to bring in more equipment to Gaza, including MSUs, prefabs, and generators, pending pre-approval from COGAT.” UNRWA is beta testing a new dashboard to track supply flows into Gaza: