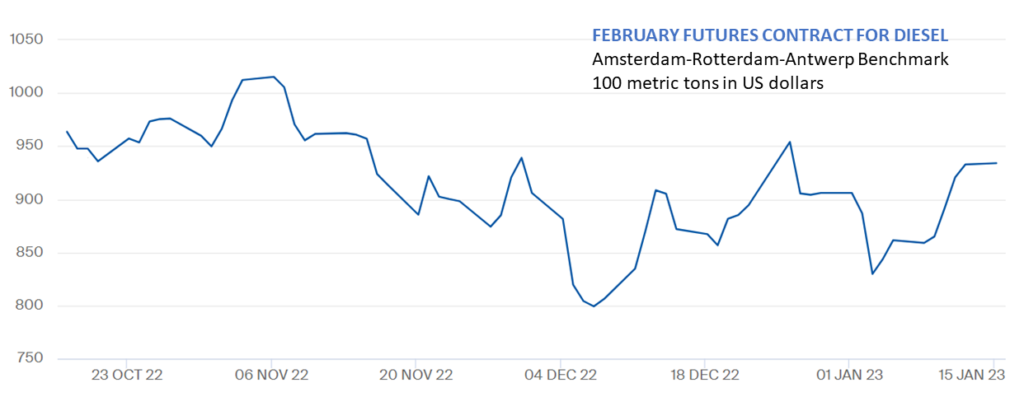

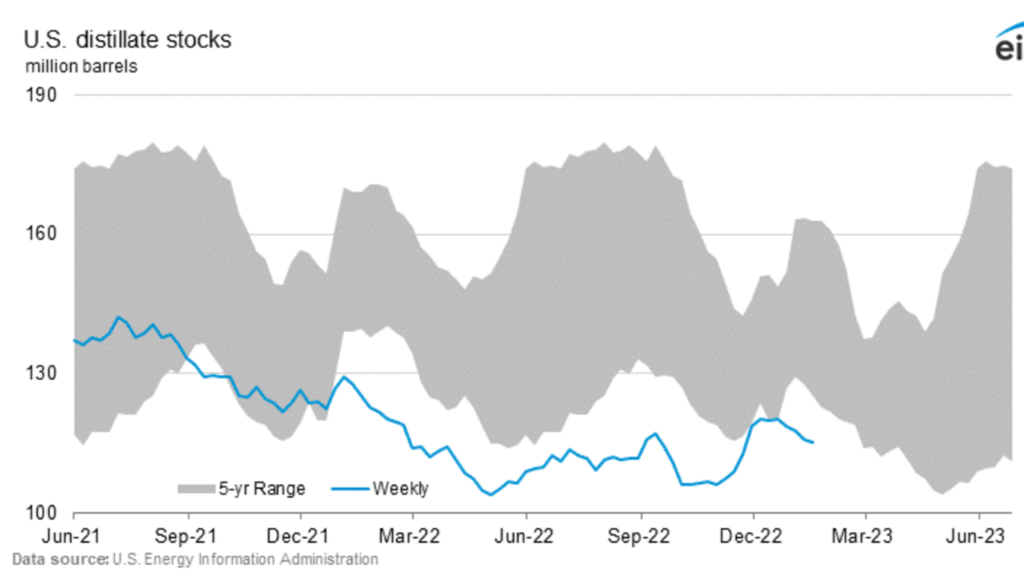

US diesel inventories are still recovering from reduced refining operations in late December. Please see chart below for levels as of January 25. (Tomorrow EIA will give us an update, but I will be airborne and offline for a few days.)

On February 5 a new set of European Union sanctions — including a ban on importing refined petroleum products from Russia — will be implemented. It was anticipated that this would prompt a spike in diesel imports from the United States. Not yet. (Fortunately for US diesel stocks and prices.)

According to S&P Global:

Counter to market expectations, Americas clean tanker freight rates have plunged ahead of the upcoming EU ban on Russian oil product deliveries to Europe, amid limitations to supply and demand of diesel. This comes as demand from Europe has yet to significantly materialize for US Gulf Coast barrels, with Russian product still traveling to Europe at significant levels and amid low US diesel export volumes. The US Gulf Coast-to-UK and Continent diesel route is showing pronounced losses. Platts, part of S&P Global Commodity Insights, assessed it at 75 worldscale — just $17.79/mt — Jan. 27, down 78% from its recent peak at 345 worldscale Dec. 2, when a strong pull for vessels from the USGC to Latin America resulted in tight tonnage on the Gulf Coast.

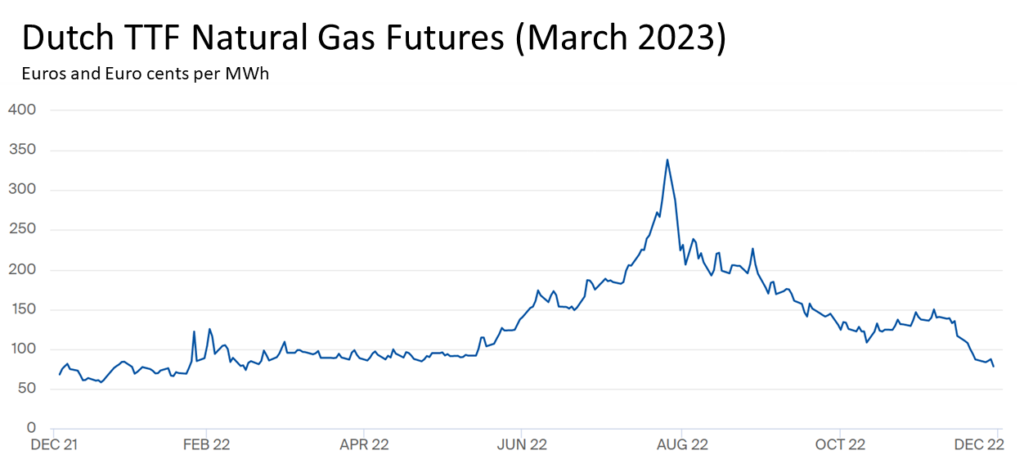

According to a mid-January report by S&P Global, Russian diesel still made up more than one quarter of Europe’s total 1.69 million b/d of imports from January 1-18. US exporters may need to wait until last-minute pulls on Russian diesel subside. Diesel flows (and prices) have also moderated as EU LNG inventories have increased (more).

+++

February 3 Update: For the week ending on January 27, the EIA reports an increase in US diesel inventories, rising from 115.3 million to 117.6 million barrels. Gulf Coast inventories increased from 38.4 million to 41.4 million. Some of this will soon be distributed up the Colonial Pipeline and by barge or ship to other regions and nations.